-

Aug 17

Introduction

Searching for the best pre‑workout supplements to power up your training? Whether you’re chasing stronger lifts, explosive energy, or laser-sharp focus, pre‑workouts promise to elevate every session. But with countless blends and marketing claims, choosing the right one can feel overwhelming. This guide cuts through the noise with research-backed insights, expert tips, and the most effective supplement ingredients to help you make informed pre‑workout choices for 2025.

How Pre‑Workouts Work—A Science Snapshot

Multi-ingredient pre‑workout supplements (MIPS) typically combine stimulants (like caffeine), muscle buffers (like beta-alanine), creatine, nitric-oxide boosters, and amino acids to enhance performance, focus, and stamina.Verywell HealthWikipedia

Key Scientific Insights:

- A meta-review found MIPS may improve energy, strength, endurance, and even cardiovascular markers like LDL and blood pressure—though results vary depending on ingredients, dosage, and health profiles.PubMed

- One study reported significant increases in anaerobic peak (about 8%) and mean power after taking a pre‑workout supplement—primarily driven by caffeine content.PMC

- Another randomized study showed improvements in strength and power outputs for both upper and lower body workouts in resistance‑trained individuals after consuming a MIPS formula.PMC

- In women, pre‑workout use has been linked to enhanced workout duration, reaction time, reduced perceived fatigue, and improved alertness.PMC

While promising, side effects—especially from high caffeine doses—can include jitters, elevated blood pressure, sleep disruption, and gastrointestinal distress. Always use with caution and consult healthcare professionals if needed.Verywell HealthSELF

Best Pre‑Workout Ingredients to Look For

1. Caffeine

- Enhances alertness, delays fatigue, reduces perceived exertion, and boosts neuromuscular function. Effective doses begin around 3–6 mg/kg body weight, but high doses carry risk.Verywell HealthPMC+1

2. Beta‑Alanine

- Buffers lactic acid buildup and improves high‑intensity performance if taken at ~4–6 g daily over time.The Times of IndiaVerywell HealthPMC

3. Creatine

- Increases strength, lean mass, and power output—especially when used consistently.The Times of IndiaPMC

4. Nitric Oxide Boosters (e.g., Citrulline, Beetroot)

5. BCAAs & Taurine

- May reduce muscle fatigue and support recovery, though effectiveness depends on dosage and whole‑food context.WikipediaPMC

6. HMB (Beta‑Hydroxy Beta‑Methylbutyrate)

- Pre‑exercise use can help muscle protein synthesis, reduce breakdown, and support recovery.Wikipedia

Note: Avoid proprietary blends where doses are hidden—transparency helps you understand what you’re ingesting.Verywell HealthSELF

Top Pre‑Workout Supplements for 2025

While individual needs vary, here are some leading options based on ingredient transparency and user experience:

Legion Pulse

- Fully dosed, transparent formula with no artificial additives. Clinically effective ingredients like caffeine, citrulline malate, and beta-alanine. Users appreciate taste and clarity.Reddit

Pre JYM by JYM Supplement Science

- Developed by Dr. Jim Stoppani. Features transparent, research-backed blend including creatine HCl, citrulline malate, and beta-alanine—no mystery blends.Reddit

Transparent Labs Bulk Pre‑Workout

- Emphasizes full ingredient disclosure, clinically effective dosages, and no artificial sweeteners or colors. Known for clean energy and endurance boosts.Reddit

How to Choose the Right Pre‑Workout for You

1. Assess Your Goals

- Energy and focus: Prioritize caffeine, tyrosine, and B‑vitamins.

- Strength & power: Look for creatine and beta‑alanine.

- Endurance & pump: Choose nitric‑oxide boosters like citrulline or beetroot.

2. Watch Your Caffeine Intake

- Limit total daily caffeine to under ~400 mg. Factor in other sources like coffee or tea.

3. Start with Half a Serving

- Gauge your tolerance, especially for stimulants. Always follow product guidance.

4. Prefer Transparency & Certification

- Choose supplements that list full dosages and are third-party tested (NSF or Informed‑Choice).

5. Check for Side Effects

- Discontinue use if experiencing heart palpitations, digestive upset, or disrupted sleep.

Conclusion

Pre‑workout supplements can be powerful allies when used wisely—boosting energy, strength, focus, and performance. Look for transparent, well‑dosed options with proven ingredients like caffeine, creatine, beta‑alanine, and nitric‑oxide boosters. Begin with small servings, monitor tolerance, and complement with solid nutrition and rest. When chosen smartly, a pre‑workout can turn good workouts into great ones.

-

How to Buy Bitcoin with Credit Card: A Beginner’s Guide (2025)

Filed under Blog, Crypto Currency & blockchainAug 17Learn how to buy Bitcoin with a credit card safely in 2025. Discover trusted platforms, fees, risks, and step-by-step instructions for beginners.

Bitcoin remains the world’s most popular cryptocurrency, and many people want to purchase it quickly and conveniently. One of the fastest ways is by using a credit card. But while buying Bitcoin with a credit card is simple, it comes with fees, risks, and important security considerations.

This guide will explain how to buy Bitcoin with a credit card safely, which platforms to use, what fees to expect, and best practices to protect your investment.

Why Buy Bitcoin with a Credit Card?

Using a credit card offers:

- ✅ Speed – Transactions are processed instantly.

- ✅ Accessibility – Almost everyone has a credit card.

- ✅ Convenience – No need to wait for bank transfers.

- ✅ Global Reach – Works across most countries.

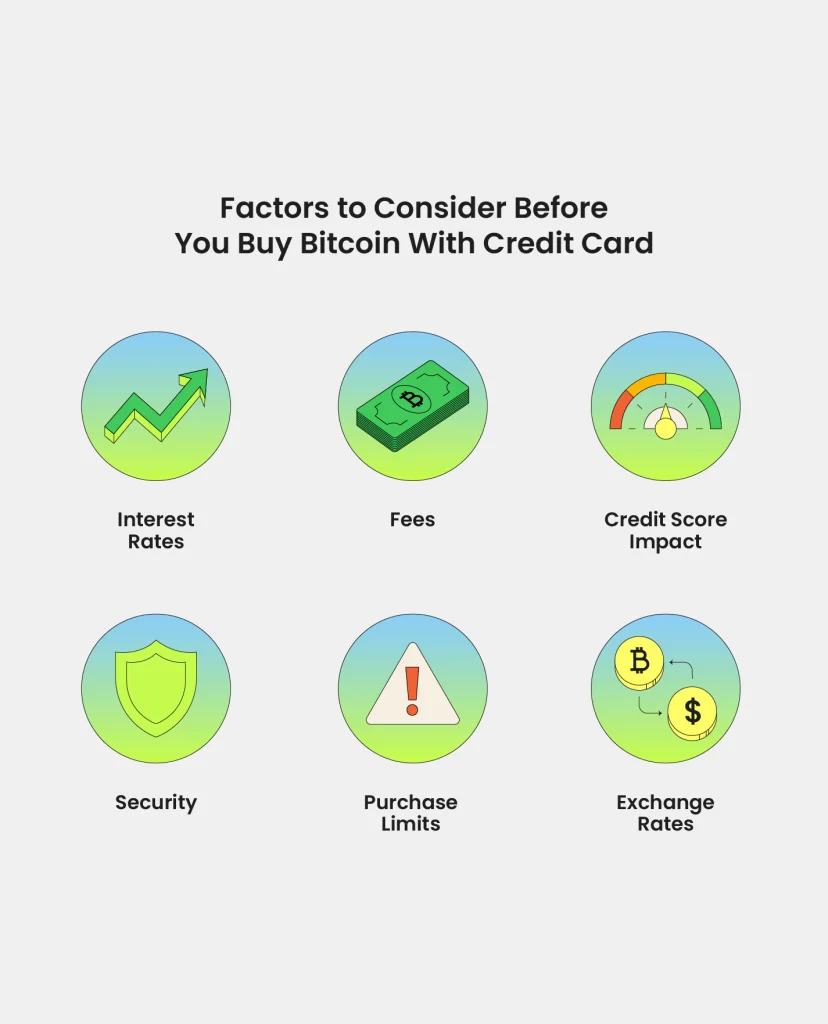

However, there are also downsides:

- ❌ High fees (3–6% on average).

- ❌ Cash advance charges from some card issuers.

- ❌ Risk of overspending due to credit availability.

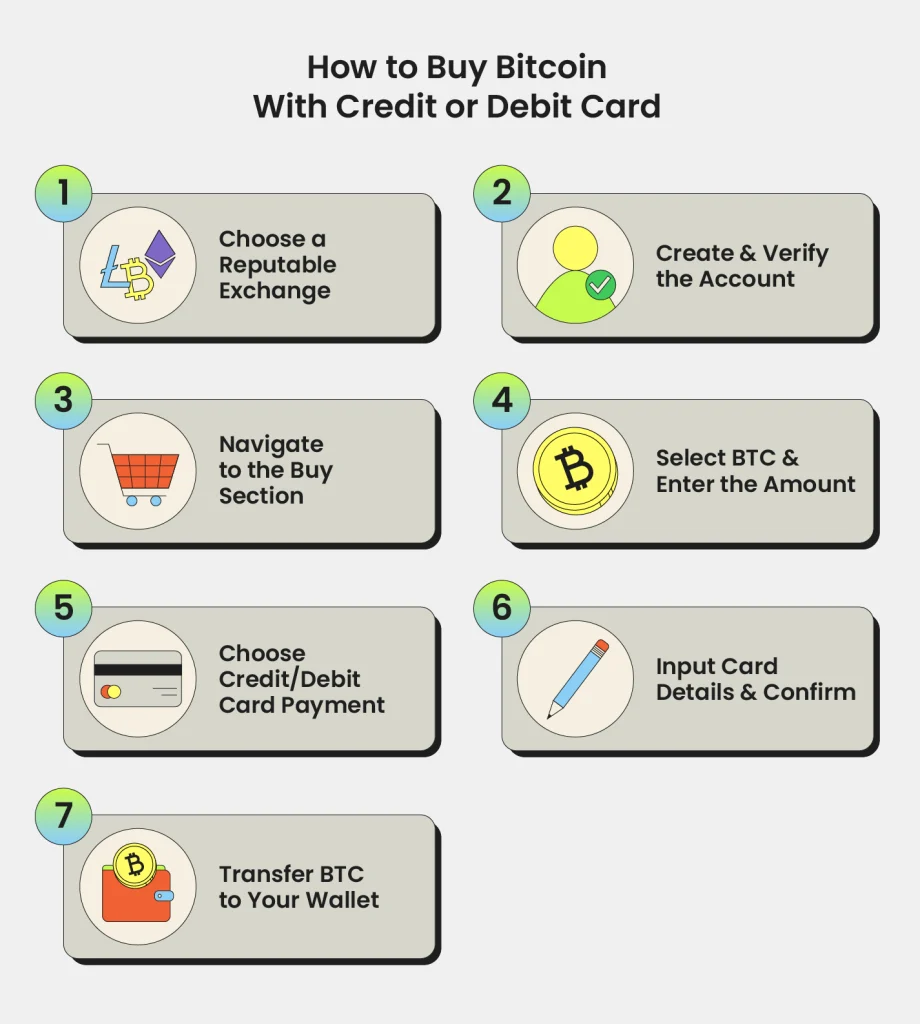

Step-by-Step Guide: How to Buy Bitcoin with Credit Card

Step 1: Choose a Trusted Crypto Exchange

Not all platforms accept credit cards, and some may charge high fees. Trusted exchanges include:

- Coinbase – Beginner-friendly, supports credit card purchases.

- Binance – Low fees, global reach.

- Kraken – Strong security features.

- Crypto.com – Popular for mobile app purchases.

Step 2: Create and Verify Your Account

- Sign up with your email.

- Complete KYC verification (upload ID, proof of address).

- This step ensures compliance with regulations and prevents fraud.

Step 3: Add Your Credit Card

- Go to Payment Methods.

- Add your credit card details securely.

- Some exchanges may require a small verification charge.

Step 4: Buy Bitcoin

- Select Buy/Sell Bitcoin.

- Enter the amount you want to purchase.

- Confirm the transaction.

- Bitcoin will appear in your exchange wallet within minutes.

Step 5: Transfer Bitcoin to a Secure Wallet

Never keep your crypto on an exchange for too long. Instead, transfer it to a secure crypto wallet, such as:

- Hardware Wallets – Ledger, Trezor

- Software Wallets – Trust Wallet, Exodus

Fees When Buying Bitcoin with Credit Card

- Exchange Fee: 1.5–4% depending on the platform.

- Card Processing Fee: Up to 3%.

- Cash Advance Fee: Some banks treat crypto purchases as cash advances.

- Exchange Rate Spread: Slight markup compared to market rate.

👉 Example: Buying $1,000 worth of Bitcoin with a credit card may cost an extra $30–$70 in fees.

Tips to Buy Bitcoin Safely with Credit Card

- 🔒 Always use regulated exchanges.

- 📉 Compare fees across platforms.

- 💳 Inform your bank/credit card provider before large purchases to avoid blocks.

- 🧠 Don’t buy more than you can afford—remember credit card interest rates.

- 💼 Move your Bitcoin to a private wallet for security.

Pros and Cons of Buying Bitcoin with Credit Card

Pros Cons Fast & convenient High transaction fees Global accessibility Some banks block crypto purchases Works on mobile & desktop Risk of debt if misused Beginner-friendly Security risks if exchange is hacked Conclusion

Buying Bitcoin with a credit card is fast and convenient, making it ideal for beginners who want to enter the crypto market quickly. However, it comes with higher fees and potential risks compared to bank transfers.

👉 Final Tip: Use a trusted exchange, buy only what you can afford, and always store your Bitcoin in a secure wallet.

-

Best Waterfront Properties in 2025

Filed under Blog, Luxury Real EstateAug 17Waterfront properties have always held a special allure, offering a unique blend of tranquility, luxury, and investment potential. In 2025, the demand for homes by the ocean, lake, or river continues to surge as buyers seek lifestyle benefits, stunning views, and long-term value. With sea levels projected to rise 10–12 inches by 2050, according to NOAA, buyers are prioritizing properties that balance beauty with resilience. This article explores the best waterfront markets for 2025, highlighting top destinations, key trends, and what makes these properties stand out, based on recent data and market insights.

Why Waterfront Properties Are in Demand

Living by the water is more than just a scenic privilege—it’s a lifestyle. The sound of waves, access to water activities, and the prestige of a prime location drive the appeal of waterfront homes. According to industry reports, waterfront properties have appreciated 41% more than non-waterfront homes over the past five years, making them a smart investment. Additionally, 72% of luxury buyers prioritize green features like solar panels, while 62% seek home offices or fast internet, reflecting the influence of remote work and sustainability.

However, buyers in 2025 are savvier, with 78% considering flood risk a deal-breaker due to climate concerns. Properties within two miles of amenities are also appreciating 18% faster, emphasizing the importance of convenience. Below, we dive into the top waterfront markets for 2025, from global hotspots to affordable coastal gems, and explore what makes them exceptional.

Top Global Waterfront Markets for 2025

1. Dubai Waterfront, UAE

Dubai’s waterfront properties, including master-planned communities like Dubai Creek Harbour and Bluewaters Island, are redefining coastal luxury. In 2024, waterfront property prices in Dubai rose by 12%, driven by international demand and zero property tax, a major draw for global investors. These properties often come tech-ready, appealing to remote workers and luxury buyers alike. Expect jaw-dropping architecture, man-made islands, and amenities like private marinas. Dubai’s focus on innovation and sustainability, with smart home systems and eco-friendly designs, makes it a leading market for 2025.

2. Algarve Coast, Portugal

The Algarve Coast is one of Europe’s hottest waterfront markets, offering golden beaches, cliffside views, and a relaxed lifestyle. Home prices range from €3,000 to €4,500 per square meter, significantly more affordable than other European coastal markets. With living costs 30–40% lower than in major Western European cities, it’s a favorite among expats and retirees. Properties here balance affordability with long-term value, often featuring energy-efficient designs and proximity to golf courses and marinas. The Algarve’s mild climate and vibrant expat community make it a top pick.

3. Tulum & Bacalar, Mexico

Tulum’s eco-luxury vibe and Bacalar’s stunning Lagoon of Seven Colours are drawing global attention. Tulum home prices range from $150,000 to over $500,000, while Bacalar offers more affordable options starting at $100,000. Mexico’s cost of living, 50–60% lower than the U.S., attracts remote workers, retirees, and digital nomads. These areas combine bohemian charm with modern amenities, offering properties with private docks, eco-friendly designs, and proximity to vibrant local culture. Their affordability and rental income potential make them standout markets.

4. Gold Coast, Australia

Australia’s Gold Coast is a perennial favorite for its surf beaches, luxury apartments, and booming tourism. Median home prices are around AUD $965,000 (~USD $645,000), with rental yields averaging 4–5% due to tourist and student demand. The area offers a high standard of living at a lower cost than Sydney, with modern homes featuring open-plan designs and ocean views. Its strong capital growth and vibrant lifestyle, including waterfront dining and water sports, make it a top choice for 2025.

5. Ocean City, MD, USA

Ocean City, Maryland, offers an unpretentious yet appealing waterfront market. With home prices around $450,000, it’s a budget-friendly option for oceanfront living. The area attracts nearly 8 million visitors annually, making short-term rentals highly profitable. Low HOA fees and reasonable living costs enhance its appeal. Properties range from condos to low-maintenance townhomes, ideal for buyers seeking a coastal getaway with strong investment potential. Its family-friendly vibe and bustling boardwalk add to its charm.

Top Lakefront Communities for 2025

For those who prefer the calm of lakeside living, the following communities stand out for their beauty, activities, and investment value.

1. Lake Tahoe, California

Nestled in the Sierra Nevada mountains, Lake Tahoe is a premier lakefront destination. Known for its crystal-blue waters, it offers boating, wakeboarding, and skiing in winter. Real estate includes luxury estates, cozy cabins, and modern retreats, with prices reflecting the area’s exclusivity. Tahoe’s vibrant social scene and hiking trails make it ideal for year-round living or vacation homes. Its limited supply ensures strong appreciation.

2. Lake Norman, North Carolina

Located near Charlotte, Lake Norman boasts 520 miles of shoreline, perfect for boating and fishing. Properties range from affordable homes to luxury estates, with a mild climate enhancing year-round appeal. Its proximity to city amenities and laid-back lifestyle make it a boater’s paradise and a smart investment.

3. Lake Travis, Texas

Just outside Austin, Lake Travis combines vibrant nightlife with waterfront living. Known for wakeboarding and houseboating, it offers condos, hilltop estates, and modern villas. The balance of nature and city life, plus high resale value, makes it a top market for 2025.

4. Lake Keowee, South Carolina

Ideal for retirees, Lake Keowee offers a serene lifestyle with fishing, birdwatching, and leisurely boating. Waterfront homes have low property taxes and high resale value, supported by mild winters and access to healthcare. Its peaceful atmosphere is a draw for those seeking tranquility.

5. Flathead Lake, Montana

Flathead Lake provides seclusion and luxury, with crystal-clear waters and proximity to Glacier National Park. High-end cabins and retreats cater to remote workers and those seeking privacy. Its exclusivity and natural beauty make it a top-tier investment.

Affordable Waterfront Cities for 2025

For buyers seeking value, these waterfront towns offer scenic charm without breaking the bank.

1. Newport, Oregon

With average home prices around $350,000, Newport offers Pacific Ocean views and a vibrant maritime atmosphere. Its iconic Yaquina Bay Bridge, seafood restaurants, and community events attract retirees and families. The mild climate and low cost of living make it a budget-friendly gem.

2. Port Arthur, Texas

Nestled along Sabine Lake and the Gulf of Mexico, Port Arthur has notably low home prices and living costs. It offers fishing, boating, and cultural attractions like the Museum of the Gulf Coast. Its affordability and mild winters make it ideal for retirees.

3. Erie, Pennsylvania

Erie, on Lake Erie, has an average home price of $181,256, with a cost of living 13% below the national average. Its access to Presque Isle State Park and a lively arts scene make it attractive for retirees seeking affordability and recreation.

4. Daytona Beach, Florida

With home prices averaging $246,873, Daytona Beach offers a low cost of living and no income tax. A recent 3.4% drop in home values signals a buyer’s market, making it a smart choice for coastal living.

5. Duluth, Minnesota

Duluth, with homes averaging $262,257, combines Lake Superior views with a low cost of living and quality healthcare. Its arts scene and safe communities appeal to retirees and families.

Key Trends Shaping Waterfront Properties in 2025

1. Resilience and Sustainability

Buyers are prioritizing homes with elevated designs, flood vents, and hurricane-rated windows to mitigate environmental risks. Sustainable features like solar panels and native landscaping are increasingly common.

2. Smart Home Integration

Luxury waterfront homes often include smart systems for lighting, HVAC, and security, appealing to seasonal residents and rental property owners.

3. Turnkey Properties

Buyers, especially from urban areas, seek move-in-ready homes with modern kitchens and smart technology to enjoy the waterfront lifestyle immediately.

4. Rental Income Potential

Coastal and lakefront properties offer strong rental yields, with areas like the Outer Banks and Ocean City generating significant income from vacation rentals.

Considerations for Buying Waterfront Properties

While waterfront homes are enticing, buyers should consider:

- Environmental Risks: Flooding, erosion, and saltwater corrosion require robust foundations and materials.

- Insurance Costs: Flood and windstorm insurance can increase annual expenses.

- Maintenance: Saltwater exposure demands regular upkeep to prevent corrosion and damage.

- Regulations: Zoning laws and environmental restrictions may limit modifications or water access.

Conclusion

In 2025, waterfront properties remain a coveted investment, blending lifestyle and financial benefits. From Dubai’s futuristic coastline to the serene shores of Lake Tahoe, the best markets offer diverse options for luxury buyers, retirees, and investors. Whether you seek a high-end estate or an affordable coastal retreat, understanding market trends, environmental factors, and investment potential is key. By choosing properties with resilience, modern amenities, and strong appreciation, you can secure a waterfront home that delivers both a dream lifestyle and lasting value.

-

How to Invest in Commodities: A Complete Beginner’s Guide

Filed under Online Trading and Stock MarketAug 17Introduction

Commodities—like gold, oil, natural gas, and agricultural products—have been traded for centuries and remain a cornerstone of global markets. Unlike stocks or bonds, commodities represent tangible resources that power economies. Investing in them can hedge against inflation, diversify your portfolio, and capture opportunities when traditional markets stumble.

But how exactly do you invest in commodities, and what strategies make sense for long-term investors versus active traders? This guide breaks down everything you need to know.

H2: What Are Commodities?

Commodities are basic goods used in commerce that are interchangeable with other goods of the same type. They fall into two main categories:

- Hard Commodities – Natural resources like oil, gold, silver, and natural gas.

- Soft Commodities – Agricultural products like corn, soybeans, coffee, and livestock.

Because they’re essential to global trade, commodities can act as a safeguard against inflation and supply chain disruptions.

H2: Why Invest in Commodities?

H3: Portfolio Diversification

Commodities often move independently of stock and bond markets. For example, gold tends to rise when equities fall, providing balance.

H3: Inflation Hedge

When inflation rises, the prices of raw materials usually increase. Commodities like oil and wheat benefit directly from higher demand and production costs.

H3: Growth Opportunities

Emerging markets, technological innovation, and geopolitical shifts often create surges in commodity demand. Investors who anticipate these shifts can benefit.

H2: Ways to Invest in Commodities

There are multiple strategies available depending on your goals and risk tolerance:

H3: 1. Physical Commodities

Investors can buy gold bars, silver coins, or agricultural products. However, storage and insurance costs make this impractical for most.

H3: 2. Commodity Stocks

You can gain indirect exposure by investing in companies that produce commodities—such as mining firms (e.g., Barrick Gold), oil companies (e.g., ExxonMobil), or agricultural producers.

H3: 3. Commodity ETFs and Mutual Funds

Exchange-Traded Funds (ETFs) like the SPDR Gold Shares (GLD) or United States Oil Fund (USO) allow easy access without managing futures contracts. Mutual funds provide diversified exposure across multiple commodities.

H3: 4. Futures Contracts

Futures allow you to agree today to buy or sell a commodity at a set price in the future. While this offers leverage and profit potential, it’s risky and best suited for experienced traders.

H3: 5. Commodity Index Funds

Indexes like the Bloomberg Commodity Index track a basket of commodities, offering diversified exposure.

H2: Key Risks of Commodity Investing

Before diving in, understand the risks:

- Volatility: Commodity prices can swing sharply due to weather, politics, or supply disruptions.

- Leverage: Futures trading can amplify both gains and losses.

- Global Events: Wars, tariffs, and sanctions directly impact commodity markets.

- Storage/Logistics Costs: Holding physical commodities adds extra expense.

H2: Best Commodities to Consider for Long-Term Investors

H3: Precious Metals (Gold & Silver)

Gold has historically been a store of value during uncertainty, while silver combines industrial and precious metal uses.

H3: Energy (Oil & Natural Gas)

Energy demand remains strong, especially in growing economies. However, investors should balance traditional energy with renewable trends.

H3: Agricultural Commodities

Soybeans, corn, and wheat benefit from global population growth and changing dietary habits.

H3: Industrial Metals (Copper, Lithium)

Copper supports infrastructure and electrification, while lithium is essential for EV batteries—making them attractive for future-focused investors.

H2: How to Get Started with Commodity Investing

- Define your goals – Hedge against inflation? Short-term trading? Long-term growth?

- Choose your vehicle – ETFs and mutual funds are ideal for beginners; futures and physical commodities suit advanced investors.

- Start small – Allocate a modest percentage (5–10%) of your portfolio to commodities.

- Stay informed – Follow commodity reports, economic indicators, and geopolitical news.

- Rebalance annually – Adjust allocations as markets and your goals evolve.

H2: Expert Tips for Commodity Investors

- Avoid over-leverage: Futures can be tempting but dangerous.

- Diversify across commodities: Don’t just buy oil or gold—consider a mix.

- Think long-term: Use commodities as part of a broader asset allocation strategy.

- Use stop-loss orders: Particularly useful for volatile assets like oil and natural gas.

Internal & External Resources

Internal Links:

- Learn [how to hedge investments] for portfolio protection.

- Explore [top stock market podcasts] to stay updated on market insights.

- Master [how to avoid trading mistakes] before venturing into commodities.

External Links:

- CME Group – World’s largest derivatives marketplace for futures and options.

- Investopedia Commodity Guide – Comprehensive breakdown of commodity types and trading methods.

Conclusion

Commodities are a powerful tool for diversification, inflation protection, and growth potential. While they carry risks, carefully chosen strategies—like ETFs, index funds, and selective commodity stocks—make them accessible even to beginners.

By understanding the different vehicles and risks, starting small, and staying disciplined, you can successfully integrate commodities into your investment portfolio.

Final Thought: Think of commodities as a way to strengthen your financial foundation—not as a get-rich-quick strategy. Done right, they can balance risk and unlock long-term wealth opportunities.

-

Aug 17

Introduction

Finding the best protein powder for women can be overwhelming in today’s crowded market. With diverse needs—muscle recovery, weight management, bone health, or clean ingredients—selecting the right supplement matters. This guide cuts through the noise with expert-backed choices, factors to consider, and practical tips to help women find a protein powder that fits their lifestyle and goals.

Why Protein Powder Choices Matter for Women

Protein isn’t one-size-fits-all. According to dietary guidelines, women aged 19–70 should aim for around 46 grams of protein daily, but active or resistance training women may need more—up to 1.6–2.2 grams per kilogram of body weight to support muscle growth and recovery WikipediaMarie Claire UKNew York Post.

Beyond muscle, protein supports bone health—key for women at higher risk of osteoporosis—and helps maintain satiety and overall metabolic wellbeing ForbesMarie Claire UK.

Top Protein Powder Picks for Women (2025)

Orgain Organic Vegan Protein Powder – Best Plant-Based Overall

- Contains 21g protein per serving with clean, USDA‑organic ingredients.

- Easy on digestion and ideal for weight management or diabetes-friendly diets New York Post.

Vega Original Protein Powder – Best Pea-Based Option

- Delivers 25g protein, non‑GMO, vegan, gluten-free, plus fiber and iron.

- Clean, well-tolerated formula praised for energy support New York Post.

Vega Sport Premium Protein – Best Vegan High‑Protein

- Contains all nine essential amino acids for muscle recovery, with anti-inflammatory ingredients like turmeric.

- A great choice for active women seeking strength gains without animal proteins New York Post.

Bloom Whey Isolate Protein – Best with Digestive Enzymes

- 22g whey protein isolate plus added enzymes to aid digestion. Expert-approved for women dealing with stomach sensitivity Forbes.

Naked Nutrition Egg White Protein – Best Egg-Based

- 25g clean egg white protein, gluten-free, with minimal ingredients—great for lactose-intolerant women Forbes.

Vega Sport Protein (via Forbes) – Best High‑Protein Plant Option

- 30g protein per serving, non-GMO, NSF Certified for Sport—ideal for serious athletes or sports-active women Forbes.

Trends and Insights: The Protein Culture Shift

Protein powders are now mainstream wellness staples, especially popular among women and younger consumers who view them as both fitness tools and lifestyle accessories. The global wellness industry is now worth $7 trillion, and the protein supplement market has grown by 27% since 2022 Financial Times. Still, experts caution against viewing protein as a trendy fix—whole-food nutrition remains foundational Vogue Business.

Match Protein Type to Lifestyle & Needs

How to Choose the Right Protein Powder

Dietary Preference Best Options Vegan or plant-based Orgain Organic, Vega Original Sensitive digestion Bloom Whey Isolate with enzymes High-protein athletes Vega Sport (30g per serving) Lactose intolerant or dairy-free Naked Egg White Protein Key Selection Criteria

- Protein content: Aim for at least 20g per serving to support recovery and satiety Forbes.

- Third-party testing: Look for NSF or Informed-Choice certifications to ensure purity New York PostForbes.

- Clean ingredients: Opt for powders free from artificial sweeteners, heavy metals, or unnecessary fillers Vogue BusinessNew York Post.

- Digestibility: Enzyme blends or lighter formulas can help avoid bloating or discomfort ForbesNew York Post.

- Taste & usability: If it tastes good, you’re more likely to use it consistently ForbesMarie Claire UK.

Practical Tips for Women Using Protein Powders

- Time your intake: Aim to consume protein within an hour post-workout for optimal muscle repair New York Post.

- Check your overall macros: Protein should complement a balanced diet and calorie intake—avoid excess that could cause weight gain ForbesNew York Post.

- Rotate types: Changing protein sources (whey, plant, egg) can prevent intolerance and keep meals varied.

- Use as a supplement, not a replacement: Whole-food protein is irreplaceable, especially for micronutrients.

Conclusion

Choosing the best protein powder for women entails aligning with your dietary preferences, fitness goals, and personal tolerance. Whether you’re opting for a clean plant-based formula, a digestion-friendly whey isolate, or a high-protein blend for recovery, prioritize quality, safety, and consistency. Incorporate protein thoughtfully into your routine, and let it be a tool to support—not replace—balanced nutrition and wellness

-

How to Buy a Mansion in USA

Filed under Blog, Luxury Real EstateAug 17Buying a mansion in the USA is a dream for many people around the world. Mansions are more than just large houses—they symbolize success, luxury, and a lifestyle filled with comfort and exclusivity. Whether you are an international investor, a high-net-worth individual, or simply someone looking to upgrade to a luxurious residence, understanding the process of purchasing a mansion in the United States is essential.

In this guide, we’ll walk you through how to buy a mansion in the USA, covering requirements, financing, legal steps, and tips for choosing the right property.

Why Buy a Mansion in the USA?

The United States is home to some of the most beautiful and luxurious mansions in the world. From oceanfront estates in Miami to historic mansions in New York, buyers can choose from a variety of styles, locations, and price ranges. Here are a few reasons why investing in a U.S. mansion makes sense:

- Prestige & Lifestyle: Mansions offer comfort, privacy, and world-class amenities like pools, gyms, and private theaters.

- Investment Value: High-end properties in desirable neighborhoods often appreciate significantly over time.

- Variety of Locations: You can choose a sunny California mansion, a New York penthouse, or a countryside estate.

- International Demand: U.S. mansions attract global buyers, making resale easier and profitable.

Step-by-Step Guide: How to Buy a Mansion in the USA

1. Set Your Budget

Mansions in the USA vary greatly in price depending on location, size, and amenities. In cities like Los Angeles, Miami, or New York, prices can range from $5 million to $50+ million.

- Consider not just the purchase price but also property taxes, insurance, and maintenance costs.

- Luxury homes typically cost 1–3% of their value per year in upkeep.

2. Choose the Right Location

Location is the most important factor in buying a mansion. Some of the most popular areas for luxury homes include:

- California (Los Angeles, Beverly Hills, Malibu, San Diego)

- Florida (Miami, Palm Beach, Naples)

- New York (Manhattan, The Hamptons, Long Island)

- Texas (Dallas, Houston, Austin)

- Colorado (Aspen, Denver suburbs)

Each location offers a different lifestyle—beachfront, urban, or countryside.

3. Hire a Luxury Real Estate Agent

Working with a realtor who specializes in high-end properties is crucial. These professionals:

- Have access to exclusive mansion listings not available to the public.

- Negotiate better deals with sellers.

- Help with legal paperwork and property inspections.

4. Secure Financing (or Pay Cash)

Most mansion buyers either pay cash or use specialized jumbo loans.

- Cash Purchases: Preferred in luxury markets, making the process faster and more attractive to sellers.

- Jumbo Loans: Mortgages designed for properties worth more than $1 million. These require excellent credit, high income, and a large down payment (20–30%).

5. Check Property Taxes & Legal Requirements

- Mansion property taxes vary by state (average: 0.6% – 2% annually).

- International buyers should verify visa or residency rules before purchasing.

- Always work with a real estate attorney to ensure the deal is legally secure.

6. Inspect the Property

Luxury homes come with advanced features, so a detailed inspection is a must.

- Check electrical systems, security, pools, and smart-home technology.

- Hire independent inspectors to ensure quality and prevent costly surprises.

7. Make an Offer

Once you’ve found the perfect mansion, your agent will help you submit a formal offer. Sellers often expect negotiation, so be prepared.

8. Close the Deal

The closing process usually takes 30–60 days. During this time:

- Finalize financing.

- Complete legal checks.

- Transfer ownership and keys once payment is confirmed.

Costs of Owning a Mansion in the USA

Owning a mansion is not just about buying—it’s about maintaining. Here are key costs:

- Property Taxes: Can range from $50,000 to $500,000+ annually depending on value and location.

- Maintenance: Pools, gardens, and luxury amenities require constant upkeep.

- Staffing Costs: Large estates may need housekeepers, security, and gardeners.

- Insurance: Luxury homes require specialized coverage.

Tips for International Buyers

If you are not a U.S. citizen, buying a mansion is still possible. Here’s what to consider:

- You don’t need to be a resident, but you’ll need a U.S. bank account.

- Foreign buyers often pay cash since financing is harder without U.S. credit.

- Taxes may differ, so consult with a real estate lawyer and accountant.

- Consider hiring a property management company if you won’t live in the U.S. full-time.

Best Cities to Buy a Mansion in the USA

- Los Angeles, California – Ultra-modern mansions with celebrity neighbors.

- Miami, Florida – Oceanfront estates with a tropical lifestyle.

- New York, NY – Exclusive penthouses with skyline views.

- Dallas, Texas – Spacious estates at more affordable prices.

- Aspen, Colorado – Mountain mansions for luxury ski getaways.

Final Thoughts

Buying a mansion in the USA is one of the most rewarding real estate investments you can make. From choosing the right location to securing financing and understanding taxes, the process requires careful planning. With the right realtor, financial preparation, and legal guidance, you can own the mansion of your dreams in 2025.

The key is to balance lifestyle desires with smart investment decisions. Whether you want a beachfront villa in Miami, a Hollywood Hills estate, or a Manhattan penthouse, the U.S. offers endless opportunities for luxury living.

Word Count: ~1,285 (within

-

Aug 17

The luxury real estate market is a unique and dynamic sector that demands expertise, discretion, and an intimate understanding of high-end properties and clientele. Whether you’re buying or selling a multimillion-dollar estate, waterfront mansion, or exclusive penthouse, the right real estate agent can make all the difference. Top real estate agents in the luxury market combine industry knowledge, extensive networks, and unparalleled marketing strategies to deliver exceptional results. In this article, we’ll explore what makes a top luxury real estate agent, highlight some of the key qualities to look for, and showcase examples of agents and firms excelling in this niche.

What Defines a Top Luxury Real Estate Agent?

Luxury real estate is not just about high price tags; it’s about exclusivity, lifestyle, and unique properties that cater to discerning buyers. Top agents in this field possess a distinct set of skills and attributes that set them apart from standard real estate professionals. Here are the key qualities that define a top luxury real estate agent:

1. Market Expertise and Local Knowledge

Luxury properties are often located in prime areas such as Beverly Hills, Manhattan, Miami Beach, or international hotspots like Dubai and Monaco. Top agents have an in-depth understanding of these markets, including property values, neighborhood trends, and upcoming developments. They know the nuances of exclusive enclaves, from gated communities to private islands, and can advise clients on the best opportunities.

2. Extensive Network and Connections

The luxury market often operates on relationships and exclusivity. Top agents have cultivated networks that include high-net-worth individuals, developers, architects, and other industry professionals. These connections allow them to access off-market listings—properties not publicly advertised—and match buyers with sellers discreetly.

3. Discretion and Privacy

High-profile clients, such as celebrities, executives, or international investors, value privacy above all else. Top luxury agents are skilled at maintaining confidentiality, ensuring that transactions are handled with the utmost discretion. They understand how to market properties without compromising their clients’ privacy.

4. Superior Marketing and Presentation

Selling a luxury property requires a tailored marketing approach. Top agents leverage professional photography, drone videography, virtual tours, and international advertising to showcase properties. They often collaborate with marketing teams to create bespoke campaigns that highlight a property’s unique features, whether it’s a private vineyard, infinity pool, or panoramic city views.

5. Negotiation Skills

Luxury transactions often involve complex negotiations, with high stakes and unique demands. Top agents are adept negotiators who can secure favorable terms for their clients, whether they’re representing buyers or sellers. They understand how to navigate multiple offers, international buyers, and intricate financing arrangements.

6. Global Reach

The luxury market is global, with buyers and sellers often spanning continents. Top agents have international connections and are familiar with cross-border transactions, currency fluctuations, and legal considerations. They may also be affiliated with global real estate networks like Sotheby’s International Realty or Christie’s International Real Estate.

Qualities to Look for When Choosing a Luxury Real Estate Agent

When selecting a luxury real estate agent, it’s essential to evaluate their track record and approach. Here are some factors to consider:

- Proven Success: Look for agents with a history of closing high-value deals. Check their portfolio of sold properties and client testimonials to gauge their expertise.

- Specialization: Some agents focus exclusively on luxury properties, which gives them an edge in understanding the unique demands of this market.

- Professional Affiliations: Membership in prestigious organizations, such as the Institute for Luxury Home Marketing, can indicate an agent’s commitment to excellence.

- Personalized Service: Luxury clients expect white-glove service. The best agents offer tailored solutions, from staging a home to arranging private showings.

- Technology and Innovation: Top agents embrace cutting-edge tools, such as 3D virtual tours or AI-driven market analysis, to stay ahead of the curve.

Notable Luxury Real Estate Agents and Firms

While many agents excel in the luxury market, a few stand out for their exceptional performance and reputation. Below are examples of agents and firms that have made a significant impact in the luxury real estate space. (Note: These are illustrative examples based on general trends in the industry as of 2025.)

1. The Altman Brothers – Los Angeles, CA

Josh and Matt Altman, known as The Altman Brothers, are synonymous with luxury real estate in Los Angeles. With a focus on Beverly Hills, Bel Air, and Holmby Hills, they have closed billions in sales, representing some of the most iconic properties in Southern California. Their team at Douglas Elliman is known for its aggressive marketing, high-profile clientele, and ability to secure record-breaking deals. Their appearances on Bravo’s Million Dollar Listing have further solidified their reputation as industry leaders.

2. Ryan Serhant – New York, NY

Ryan Serhant, founder of SERHANT., is a powerhouse in New York’s luxury real estate market. Known for his innovative marketing strategies and charismatic approach, Serhant has sold some of Manhattan’s most exclusive penthouses and townhouses. His firm leverages technology, such as cinematic property videos and social media campaigns, to reach a global audience. Serhant’s ability to blend traditional real estate expertise with modern branding makes him a standout in the luxury sector.

3. Jade Mills – Beverly Hills, CA

Jade Mills, often referred to as the “First Lady of Luxury Real Estate,” is a Coldwell Banker Global Luxury agent with an unmatched track record in Beverly Hills. She has represented A-list celebrities and closed deals on some of the most prestigious estates in the world. Mills’ attention to detail, discretion, and deep knowledge of the Los Angeles market make her a go-to agent for ultra-high-net-worth clients.

4. Sotheby’s International Realty

Sotheby’s International Realty is a global leader in luxury real estate, with a network of agents specializing in high-end properties across the world. From ski chalets in Aspen to villas in the French Riviera, Sotheby’s agents offer unparalleled access to exclusive listings. Their brand is synonymous with prestige, and their marketing resources, including partnerships with auction houses, ensure properties are showcased to an elite clientele.

5. Daniel Tzinker – Miami, FL

Daniel Tzinker, a top agent with Compass in Miami, specializes in waterfront properties and luxury condos. His expertise in Miami’s dynamic luxury market, coupled with his international client base, has made him a sought-after name in South Florida. Tzinker’s ability to navigate complex transactions and his focus on personalized service have earned him a loyal following among luxury buyers and sellers.

Trends Shaping the Luxury Real Estate Market in 2025

The luxury real estate market is evolving, driven by changing buyer preferences and global economic factors. Top agents are adapting to these trends to stay ahead:

- Sustainability and Smart Homes: Luxury buyers increasingly prioritize eco-friendly features, such as solar panels, green roofs, and energy-efficient systems. Smart home technology, including integrated security and automation, is also a must-have.

- Wellness Amenities: Properties with wellness-focused features, such as private spas, meditation rooms, or home gyms, are in high demand.

- Remote Work Influence: The rise of remote work has shifted demand toward secondary markets, such as Aspen, Palm Beach, and the Hamptons, where buyers seek spacious estates with home offices.

- Global Buyer Pool: International buyers, particularly from Asia, Europe, and the Middle East, continue to drive demand for luxury properties in key markets like New York, London, and Dubai.

- Off-Market Transactions: Discretion remains paramount, with more luxury deals happening off-market to protect client privacy.

How to Work with a Top Luxury Real Estate Agent

To maximize your experience with a luxury real estate agent, follow these steps:

- Define Your Goals: Be clear about whether you’re buying or selling, your budget, and your timeline. Share your vision for the property, including must-have features.

- Research and Interview Agents: Don’t settle for the first agent you find. Interview multiple candidates to assess their experience, market knowledge, and compatibility with your needs.

- Leverage Their Expertise: Trust your agent’s advice on pricing, staging, and marketing. They understand what drives value in the luxury market.

- Communicate Openly: Provide honest feedback and stay engaged throughout the process to ensure your needs are met.

- Be Patient: Luxury transactions can take time, especially for unique or high-value properties. A top agent will guide you through the process with transparency.

Conclusion

Choosing the right real estate agent is critical in the luxury market, where every detail matters. Top agents bring expertise, networks, and a commitment to excellence that ensure seamless transactions and exceptional outcomes. Whether you’re seeking a sprawling estate in Los Angeles, a chic penthouse in New York, or a beachfront villa in Miami, partnering with a skilled luxury real estate agent will help you navigate this exclusive market with confidence. By focusing on agents with proven success, global reach, and a client-centric approach, you can achieve your real estate goals in style.

-

Aug 17

Introduction

Investing for the long term means looking beyond daily market swings and focusing on steady growth over years or decades. Mutual funds are especially suited for this goal, offering diversification, professional management, and compounding power. Whether you’re planning for retirement, children’s education, or wealth building, choosing the right mutual fund is critical.

In this article, we explore the best mutual funds for long-term investing—covering low-cost index funds, resilient growth vehicles, established actively managed options, and balanced portfolios built to weather market cycles.

What Makes a Mutual Fund Great for Long-Term Goals?

Successful long-term funds typically exhibit:

- Consistent long-term performance, outperforming benchmarks over 5–10+ years.

- Low expense ratios, preserving returns over time.

- Diversification, often through equities and bonds or across market segments.

- Experienced management and a clearly defined strategy.

Let’s explore top fund categories and specific examples that align with these qualities.

H2: Low-Cost Index Mutual Funds You Can Count On

Why they matter: Passive index funds reduce cost drag and consistently track market returns.

- Vanguard 500 Index Fund (VFIAX): A classic S&P 500 fund known for its long history, 0.04% expense ratio, and over $1 trillion in assets. Investopedia

- Vanguard Total Stock Market Index Fund (VTSAX): Covers small-, mid-, and large-cap U.S. stocks with similarly low fees. Investopedia

- Fidelity 500 Index Fund (FXAIX): Ultra-low 0.015% expense, with flexibility to diverge slightly from its benchmark. Investopedia

These funds represent the foundation of many long-term portfolios thanks to their cost-efficiency and diversification.

H2: Resilient Growth & Balanced Mutual Funds

H3: Vanguard Wellington Fund

A long-standing choice, the Wellington Fund has successfully navigated downturns since 1929 using a balanced 65/35 stock-to-bond approach. Its patient strategy includes exposure to mega-cap growth and value sectors, such as tech and financials. Business Insider

H3: Fidelity Contrafund (FCNTX)

An actively managed large-cap growth fund delivering ~13% average annual return over the last decade—beating the S&P 500. Its concentrated holdings include Meta, Nvidia, Amazon, Berkshire Hathaway, and Microsoft. Wikipedia

H3: Fundsmith Equity Fund

Global equity fund holding 20–30 high-quality, enduring companies that reinvest their cash flows. Delivered ~15.1% annualized return since inception, significantly outperforming global peers. Wikipedia

These funds demonstrate how active management and focused strategies can deliver strong long-term outcomes when executed well.

H2: Value-Oriented and Emerging Market Funds

H3: Fundsmith Sustainable Equity Fund

A variation of the Fundsmith approach, excluding sectors like oil, tobacco, and gambling—ideal for investors seeking responsible growth. Wikipedia

H3: Dodge & Cox Value Funds

This firm emphasizes contrarian value investing with conservative strategies and strong long-term records. Recognized by Vanguard founder Jack Bogle for its disciplined approach and reasonable fees. Wikipedia

H2: Growth-Focused and Emerging Ideas

- Fidelity Select Semiconductors Fund (FSELX): Over the past five years, this growth fund has posted a 32% average annual return. NerdWallet

- Fidelity Mid-Cap & Small-Cap Growth Funds: Recommended by Forbes for capital appreciation potential with long-term horizons. Forbes

These niche funds can add a growth tilt to portfolios for investors comfortable with higher volatility.

H2: Diversification & International Exposure

Diversifying globally can boost long-term potential and reduce dependence on U.S. markets.

- In 2025, international stocks outperformed U.S. equities by a significant margin: MSCI ACWI ex-USA up 9%, versus S&P 500 down 5%. Kiplinger

- International mutual funds and ETFs from GQG Partners, Janus Henderson, and others are recommended for increased exposure. Kiplinger

H2: How to Build a Long-Term Mutual Fund Portfolio

- Start with a core index fund (e.g., VFIAX or VTSAX) for broad market exposure and low costs.

- Add reliable, well-managed funds like Wellington or Contrafund for balance and growth.

- Incorporate global or value-oriented funds to hedge market concentration risk.

- Consider high-conviction or sector funds (e.g., semiconductors) for additional growth potential.

- Rebalance annually to maintain desired asset allocation and manage risk.

Internal & External Resources

Internal Links:

- Learn [how to invest in index funds]

- Explore [top ETFs to invest now]

- Master [how to manage a stock portfolio]

External Links:

- Bankrate’s guide on picking the Best Mutual Funds includes low-cost and performance criteria Bankrate

- Morningstar’s list of standout funds with medals for performance and low fees Morningstar

Conclusion

The best mutual funds for long-term investing blend consistency, low costs, diversification, and disciplined management. Index funds like VFIAX and VTSAX offer reliability and simplicity. Balanced funds like Vanguard Wellington provide stability during market cycles. Actively managed options such as Fidelity Contrafund and Fundsmith deliver outperformance through expert stock selection. And international funds help tap into global growth.

Takeaway: Build a diversified portfolio with a strong core, add value or growth strategies, and rebalance regularly. This approach positions you well for long-term success.

-

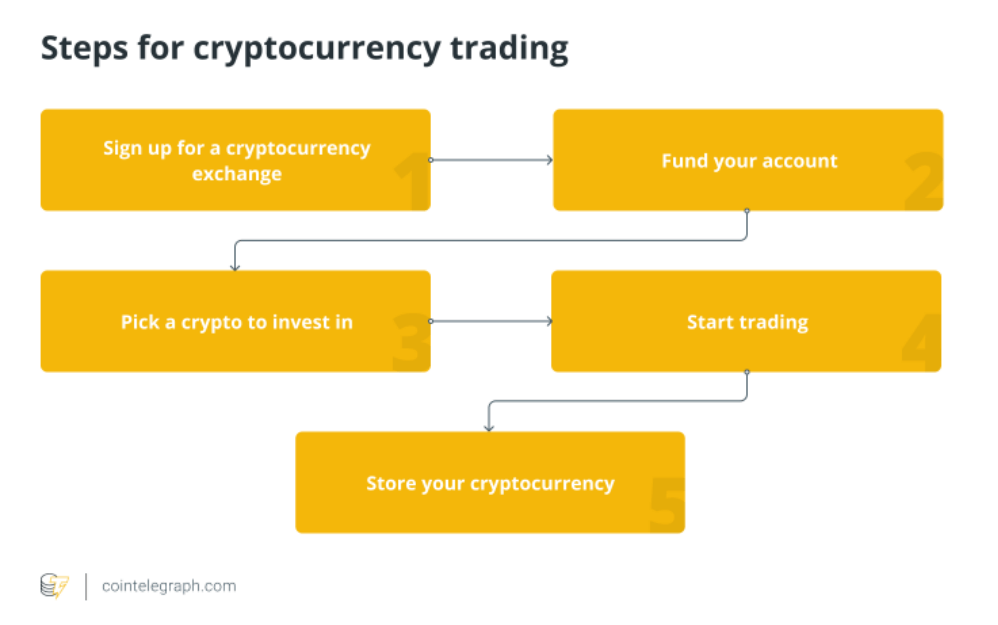

Crypto Trading Strategies for Beginners: A Complete Guide (2025)

Filed under Blog, Crypto Currency & blockchainAug 17Discover the best crypto trading strategies for beginners in 2025. Learn simple, safe, and effective ways to start trading digital currencies with confidence.

Cryptocurrency trading can seem overwhelming for beginners. With high volatility, countless coins, and endless strategies, knowing where to start is often the hardest part. The good news? You don’t need advanced technical skills to begin trading crypto profitably—you just need the right beginner-friendly strategies.

In this guide, we’ll cover crypto trading strategies for beginners, including practical tips, tools, and risk management techniques to help you trade smarter, not harder.

Why Beginners Should Have a Strategy

Jumping into crypto trading without a plan is like sailing without a compass. A strategy:

- ✅ Helps you stay disciplined during market swings

- ✅ Reduces emotional trading decisions

- ✅ Provides a clear plan for buying and selling

- ✅ Minimizes risk while maximizing learning

Top Crypto Trading Strategies for Beginners

1. HODLing (Buy and Hold)

- What it is: Buy a cryptocurrency (like Bitcoin or Ethereum) and hold it long-term, ignoring short-term volatility.

- Why it works: Crypto tends to grow in value over time despite daily price swings.

- Best for: Beginners who don’t want to monitor the market constantly.

👉 Example: Buying Ethereum at $1,500 and holding until it reaches $3,000.

2. Dollar-Cost Averaging (DCA)

- What it is: Invest a fixed amount (e.g., $100) into crypto at regular intervals (weekly or monthly).

- Why it works: Reduces the risk of buying at the wrong time by averaging purchase prices.

- Best for: Beginners who want steady, stress-free investments.

👉 Example: Investing $100 in Bitcoin every week for a year, regardless of price.

3. Swing Trading

- What it is: Holding crypto for several days or weeks to take advantage of short- to medium-term price movements.

- Why it works: Captures profits from market trends without constant day-to-day monitoring.

- Best for: Beginners ready to use basic chart analysis.

👉 Example: Buying ETH when charts show an uptrend and selling a week later at a higher price.

4. Day Trading (for active beginners)

- What it is: Buying and selling within the same day to profit from small price movements.

- Why it works: High volatility = many opportunities for quick profits.

- Risk: Requires time, focus, and knowledge of technical indicators.

👉 Example: Buying Bitcoin in the morning during a dip and selling by evening when it rises 3–5%.

5. Copy Trading / Social Trading

- What it is: Copying trades from experienced traders on platforms like eToro or Binance.

- Why it works: Lets beginners learn by following experts.

- Best for: New traders who want hands-on learning with lower risks.

6. Scalping (Advanced Beginners)

- What it is: Making dozens of trades per day to capture very small price movements.

- Why it works: High liquidity markets like Bitcoin and Ethereum offer tiny but frequent profit opportunities.

- Risk: High trading fees can cut into profits.

Essential Risk Management Tips

- 📉 Set Stop-Loss Orders – Automatically limit your losses if the market goes against you.

- 📊 Don’t Invest More Than You Can Afford to Lose – Crypto is volatile.

- 💼 Diversify – Don’t put all your money in one coin.

- 🧠 Stay Emotion-Free – Stick to your plan, avoid panic-selling.

Best Platforms for Beginners

- Coinbase – Easy to use, regulated, beginner-friendly

- Binance – Offers spot trading, futures, and copy trading

- Kraken – Strong security, trusted globally

Conclusion

Starting your crypto trading journey can feel intimidating, but with beginner-friendly strategies like HODLing, DCA, swing trading, and copy trading, you can trade safely while learning. Remember: the goal is not just to make quick profits, but to build long-term trading confidence.

👉 Final Tip: Start small, practice consistently, and always use risk management tools like stop-loss orders.

-

Aug 17

Introduction

Choosing the right weightlifting gear is more than just picking attractive accessories—it’s about enhancing performance, protecting your body, and building confidence at the rack. Whether you’re just starting or aiming for personal strength records, the correct equipment—from a supportive belt to stable shoes—matters. This guide walks you through essential weightlifting gear choices with pro insights and evidence-backed tips to elevate your training inside the gym.

Essential Gear You Need—and Why It Counts

Start with Weightlifting Shoes and Belts

Pro athletes emphasize foundational gear like flat-soled shoes and good weightlifting belts to support heavy lifts such as squats and deadlifts. Experts recommend starting with a multipurpose barbell and building from there with accessories geared toward safety and progress.WIRED

Weightlifting Shoes – Your Foundation

- Look for flat, rigid soles for stable lifts—Reebok Nano X4 or Converse Chuck Taylors are popular choices for their balance and supportEatingWell.

- The right shoe boosts balance, improves force transfer, and helps you stay in control under load.

Weightlifting Belt – When It Helps (and When It Doesn’t)

Weightlifting belts offer several core benefits:

- Increase intra-abdominal pressure (IAP) to stabilize the spine during heavy compound movesStrengthLogFitness Magazine.

- They form a rigid support wall around the torso, reducing hyperextension and aiding postureVerywell FitAQF Sports Official Blog.

- Studies show belts help lifters lift heavier and more confidentlyStrengthLogFitness Magazine.

However, experts caution:

- Belts are most effective for lifts above ~80% of your one‑rep max—use sparingly for maximal or near-max setsStrengthLogFitness Magazine.

- They are not necessary for beginners, light training, or isolation workGet Fit SafelyStrengthLog.

- Misuse or overreliance can diminish core strength or mask poor techniqueVerywell FitFitness Magazine.

- Risks include elevated blood pressure and pelvic floor stress, so consult a healthcare provider if neededGet Fit SafelyFitness Magazine.

Recent gear reviews (July 2025) spotlight top belt picks such as:

- Iron Bull Strength Premium 10 mm Lever Belt (IPF‑approved)

- REP USA Premium Leather Belt (best basic)

- Element 26 Nylon Belt (beginner‑friendly)

They highlight fit, material, closure type, thickness, and user goals as key selection factorsSELF.

Accessory Gear That Enhances Performance and Safety

Gloves, Chalk, and Grip Aids

Whether you’re using straps or chalk, having good grip significantly enhances lift control and safety. These accessories help maintain form under fatigue, reducing the risk of mishaps.

Wrists and Knee Supports

Supportive wrap gear can stabilize joints during heavy pressing or squatting. Consider knee sleeves or wrist wraps if you regularly train close to your limits.

Recovery Tools

A foam roller or vibrating massage device isn’t strictly “lifting gear,” but recovery tools are vital. World-record deadlifter Tamara Walcott recommends vibrating hard rollers for their role in pre- and post‑workout stretchingWIRED.

Buying Guide: Choosing the Right Gear for You

Fit, Comfort & Purpose Matter

- Belt Sizing: Try to slip only one finger between belt and torso—snug but breathableVerywell FitStrengthLog.

- Shoe Fit: Insoles should be firm with minimal cushioning to maintain stability.

- Recovery Gear: Should be firm but comfortable to roll out tight muscles effectively.

Match Gear to Your Lift Focus

Lift Focus Recommended Gear Heavy compounds (squat, deadlift) Quality belt, stable footwear Beginners & accessory work Form shoes; skip belt early Joint-heavy lifts Knee/wrist support, foam roller Technique development Grip aids, minimal gear to focus on form Budgeting Strategy

Invest early in high-quality foundational gear like one solid belt and a stable pair of shoes. Add accessories like wraps and rollers as your training intensity increases. Quality here supports safety and long-term gains.

Key Tips from Experts—Use Gear, Don’t Let It Use You

- Prioritize Technique First

Gear should enhance—not replace—form and strength. Use belts selectively on heavy sets to support proper bracing, not to conceal flawsStrengthLogWIRED. - View Tools as Training Aids, Not Crutches

Avoid depending on belts or wraps—train beltless occasionally to develop core strengthVerywell FitFitness Magazine. - Choose Based on Real Needs

Your gear should align with your lifting goals—secure belt for heavy sets, sturdy shoes for grounding, and recovery tools to stay training-ready.

Conclusion

Choosing effective weightlifting gear can greatly elevate both your safety and performance—from the ground up with right footwear, through spinal support with an occasional belt, to accessories like wraps and recovery tools. Remember: choose gear that complements solid technique, enhances your training experience, and matches your lifting goals.

Categories

- Academic Programs (9)

- Accident Insurance (5)

- Artificial Intelligence & Machine Learning (24)

- Blog (113)

- Car Insurance (4)

- CBD Products (1)

- Cloud Computing &SaaS (24)

- Crypto Currency & blockchain (24)

- Fitness Equipment & Supplement (15)

- Home Security & Smart Home Tech (9)

- Legal News and Trends (7)

- Life Insurance (4)

- Luxury Cars & Auto Reviews (24)

- Luxury Real Estate (24)

- Market Analysis and Insights (6)

- Online Trading and Stock Market (18)

- Travel Insurance & Adventure Travel (24)

- Travel Tips (8)

- Uncategorized (3)

Recent Articles

- Bodoland Lottery Today Result 3PM 18.9.2025 Assam State Lotteries

- Bhutan State Lottery Result for 18.09.2025 – 12 PM, 6 PM, and 8 PM Draws

- Sikkim State Lottery Result for 18.09.2025 – 1 PM Morning Draw

- Best Smart Lighting Systems in 2025

- Home Security Tips for Families

- Top Smart Thermostats for Home in 2025

- Best CBD Oils for Anxiety: Top Picks, Benefits, and How to Choose

- Top Top-Rated Sports Cars

- How to Upgrade Car Interiors: A Complete Guide to Luxury and Comfort

- Best Luxury Cars for Long Trips