-

Aug 17

Introduction

Trading can be both exciting and rewarding, but it’s also one of the most challenging pursuits in the financial world. Studies show that nearly 80% of new traders lose money within their first year, often because of avoidable errors. The truth is, avoiding mistakes is just as important as finding the right opportunities. By understanding common pitfalls and developing strategies to sidestep them, you can improve your odds of success and trade with greater confidence.

In this guide, we’ll explore the most common trading mistakes investors make, why they happen, and most importantly—how to avoid them.

H2: Why Trading Mistakes Happen

Mistakes in trading aren’t just about bad luck; they usually stem from human psychology, lack of preparation, or poor risk management. Here are some of the top reasons:

- Emotional decision-making: Fear and greed often override logic.

- Lack of a clear plan: Jumping into trades without defined goals.

- Overconfidence: Believing you can outsmart the market without proper research.

- Poor risk management: Putting too much capital into a single position.

Understanding why mistakes happen is the first step toward avoiding them.

H2: Common Trading Mistakes and How to Avoid Them

H3: Trading Without a Plan

One of the biggest mistakes beginners make is jumping in without a roadmap. A trading plan should outline:

- Entry and exit strategies

- Risk management rules

- Profit targets

- Criteria for choosing trades

Solution: Write down your plan and follow it consistently. A plan provides structure and prevents emotional decision-making.

H3: Ignoring Risk Management

Risk management is the backbone of long-term success. Many traders risk far too much capital on a single trade, hoping for quick gains.

How to avoid it:

- Never risk more than 1–2% of your account on one trade.

- Always use stop-loss orders.

- Diversify your trades instead of putting all your money in one basket.

H3: Overtrading

The excitement of trading often leads to overtrading—making too many trades in a short period without proper analysis.

Fix:

- Limit the number of trades you make daily or weekly.

- Focus on quality setups instead of quantity.

- Remember: patience often pays more than constant activity.

H3: Letting Emotions Control Decisions

Fear of missing out (FOMO) and panic selling are two common emotional traps.

Prevention Tips:

- Stick to your strategy instead of chasing trends.

- Accept losses as part of the process.

- Keep a trading journal to analyze emotional patterns.

H3: Neglecting Education

Markets evolve constantly. Traders who fail to learn and adapt quickly fall behind.

Avoid this by:

- Reading investment books regularly ([best investment books 2025]).

- Following reputable stock market podcasts ([top stock market podcasts]).

- Taking courses or practicing on demo accounts.

H3: Ignoring Market Trends

Jumping into trades without considering the broader trend can lead to losses.

Tip:

- Use technical indicators like moving averages or RSI.

- Follow economic news that may affect sectors ([how to analyze market trends]).

- Trade in the direction of the market, not against it.

H3: Not Reviewing Performance

Many traders repeat mistakes because they never track their past trades.

How to fix this:

- Maintain a trading journal with entries, exits, emotions, and results.

- Review weekly or monthly to identify patterns.

- Adjust strategies based on data, not emotions.

H2: Pro Tips for Avoiding Trading Mistakes

Here are actionable ways to build discipline and resilience:

- Set realistic goals – Avoid expecting overnight wealth.

- Start small – Trade with a demo or minimal capital first.

- Automate when possible – Use trading alerts and limit orders.

- Stay updated – Follow reliable sources like Investopedia and Morningstar.

- Practice patience – Waiting for the right opportunity often beats jumping in too soon.

H2: Internal & External Resources

- Internal Links:

- Learn how to protect your portfolio with [how to hedge investments].

- Explore strategies for [how to manage stock portfolio].

- Get insights on [top penny stocks to watch].

- External Links:

Conclusion

Trading mistakes are inevitable—but they don’t have to be devastating. By creating a clear plan, managing risk wisely, controlling emotions, and committing to lifelong learning, you can drastically reduce costly errors.

Final Thought: Success in trading isn’t about avoiding losses altogether—it’s about managing them effectively and letting your winning trades outweigh your losers. Start small, stay disciplined, and make learning part of your strategy.

-

Best Luxury Homes for Sale 2025

Filed under Blog, Luxury Real EstateAug 17

Best Luxury Homes for Sale 2025

The real estate industry is evolving rapidly, and 2025 has already proven to be an exceptional year for luxury properties. With rising demand for exclusive homes that combine comfort, innovation, and elegance, luxury buyers are looking for more than just a place to live—they’re seeking an investment, a lifestyle, and a personal sanctuary. Whether it’s a waterfront villa, a city penthouse, or a sprawling countryside estate, the best luxury homes for sale in 2025 reflect a perfect balance of modern architecture, smart technology, and timeless design.

This article explores the defining features of today’s luxury homes, the hottest locations to find them, and insider tips for buying in this competitive market.

Why 2025 Is the Best Year to Buy a Luxury Home

1. Growing Demand for Exclusive Properties

The market for luxury real estate has been thriving globally. Buyers from tech entrepreneurs to international investors are competing for prime properties. Limited availability in sought-after neighborhoods makes luxury homes even more desirable.

2. Smart Technology at the Forefront

Luxury homes in 2025 aren’t just about size or design—they’re about innovation. AI-powered assistants, biometric entry systems, automated climate control, and fully integrated smart kitchens are now standard in top-tier properties.

3. Sustainability and Eco-Friendly Design

With climate awareness on the rise, modern buyers are prioritizing eco-conscious living. Expect homes with solar panels, water recycling systems, and sustainable building materials that reduce environmental impact without compromising style.

Defining Features of the Best Luxury Homes in 2025

Luxury homes stand apart because of their unique offerings. Here are the most in-demand features that buyers are looking for this year:

1. Smart Home Automation

- Voice-activated controls for lighting, music, and security.

- AI-driven energy-saving systems that optimize electricity and heating use.

- Remote monitoring for complete peace of mind.

2. Expansive Outdoor Living Spaces

- Infinity pools that blend seamlessly with ocean or mountain views.

- Rooftop terraces with fire pits and outdoor kitchens.

- Landscaped gardens designed for privacy and relaxation.

3. Custom-Built Interiors

- Imported marble flooring and designer fixtures.

- Floor-to-ceiling windows for natural light and breathtaking views.

- Personalized touches such as home libraries, wine cellars, or art galleries.

4. Exclusive Amenities

- Private gyms and wellness spas.

- Home theaters with cinematic experiences.

- Secure underground garages with space for luxury cars.

5. Architectural Innovation

- Futuristic designs blending glass, steel, and natural materials.

- Open-concept living that seamlessly connects indoor and outdoor spaces.

- Sustainable architecture with a focus on longevity and efficiency.

Top Destinations for Luxury Homes in 2025

Luxury properties are always influenced by location. In 2025, the following markets are trending among high-net-worth buyers:

United States

- Miami, Florida: Known for its stunning beachfront villas and glamorous lifestyle.

- Los Angeles, California: Beverly Hills and Malibu continue to attract celebrities with ultra-modern mansions.

- New York City: Luxury penthouses offering skyline views and exclusive amenities remain in high demand.

Middle East

- Dubai, UAE: Famous for futuristic architecture and waterfront residences on Palm Jumeirah.

- Abu Dhabi: Rising interest in sustainable luxury homes with eco-friendly designs.

Europe

- London, UK: A blend of historic estates and modern high-rise luxury apartments.

- Paris, France: Elegant townhouses with a classic European charm.

- Spanish Coastlines: Marbella and Ibiza offer seaside villas with unmatched beauty.

Asia-Pacific

- Singapore: High-tech smart condos with world-class facilities.

- Tokyo, Japan: Ultra-modern luxury apartments in exclusive districts.

- Bali, Indonesia: Scenic villas for buyers looking for tropical retreats.

Luxury Home Market Trends in 2025

The market for high-end properties is influenced by global economic conditions, lifestyle changes, and buyer expectations. Some of the major trends include:

- Remote Work and Flexible Living

Luxury buyers want homes with private offices, conference rooms, and tech-friendly environments. - Wellness-Oriented Design

Features like meditation gardens, in-house spas, and fitness zones are becoming standard. - Privacy and Security

Demand for gated communities, biometric access, and discreet locations is stronger than ever. - Second Homes as Investments

Many high-net-worth individuals are buying luxury vacation homes that double as rental investments.

How to Buy the Best Luxury Homes in 2025

Purchasing a high-end property requires careful planning and expert guidance. Here are some essential steps:

1. Hire a Specialized Luxury Realtor

Work with an agent experienced in the luxury market to access exclusive listings and negotiate effectively.

2. Evaluate the Location

Look for areas with long-term value growth, accessibility, and lifestyle benefits.

3. Inspect Smart and Sustainable Features

Ensure the property includes the latest home automation and eco-friendly technologies.

4. Consider Investment Potential

Luxury homes should not only provide comfort but also appreciate in value over time.

5. Use Trusted Platforms

Top real estate websites and private luxury networks often feature exclusive listings that are not available to the general public.

Tips for First-Time Luxury Buyers

If you are buying your first luxury home in 2025, keep these tips in mind:

- Do Not Rush: Luxury markets are competitive, but patience ensures better deals.

- Plan for Customization: Many luxury homes can be further tailored to fit your lifestyle.

- Check Financing Options: High-end mortgages may have unique terms—compare before committing.

- Understand Taxes & Maintenance: Luxury estates often come with additional property taxes and upkeep costs.

Conclusion

The best luxury homes for sale in 2025 are more than just properties—they are lifestyle statements. With smart automation, eco-friendly architecture, and prime locations, these homes are designed to offer unmatched comfort and exclusivity. Whether you’re searching for a beachfront mansion in Miami, a penthouse in Dubai, or a countryside estate in Europe, the luxury market in 2025 has something extraordinary for every buyer.

Investing in luxury property today not only provides an elegant living space but also ensures long-term value and prestige. If you’re ready to take the leap, start your journey with a trusted realtor and explore the incredible opportunities waiting in this year’s luxury housing market.

-

Aug 17

Introduction

Podcasts have revolutionized how investors stay informed—whether you’re commuting, working out, or simply scrolling. In 2025, the best stock market podcasts offer the perfect blend of expert interviews, timely analysis, and strategic insights. Whether you’re a beginner or seasoned investor, listening to market-savvy voices can sharpen your decision-making, expand your knowledge, and keep you up to date on shifting trends.

What Makes a Great Stock Market Podcast?

A standout market podcast typically features:

- Credible hosts—finance experts, analysts, or seasoned investors.

- Actionable insights—not just commentary but investment lessons.

- Regular updates—weekly or multiple episodes per week.

- Audio clarity—well-produced, easy-to-follow listening.

H2: Must-Listen Stock Market Podcasts

H3: We Study Billionaires

Best Overall Investing Podcast

Hosts delve into strategies from megainvestors like Buffett and Marks, translating their wisdom into practical investing tactics. Covers value investing, macroeconomics, and even crypto.The Investor’s Podcast NetworkH3: Motley Fool Money

Great for Weekly Market Recap

A lively, accessible discussion on the week’s biggest investing developments, news, and stock ideas—ideal for intermediates looking for digestible, actionable insights.The Investor’s Podcast NetworkH3: The Intrinsic Value Podcast

Perfect for Beginners

Host Shawn O’Malley breaks down companies and valuations in understandable, narrative-driven episodes—excellent for those learning analysis and company fundamentals.The Investor’s Podcast NetworkH3: Top Traders Unplugged

Ideal for Advanced Traders

In-depth interviews with elite traders, economists, and macro strategists exploring topics like trend-following, global macro, and trading psychology.The Investor’s Podcast NetworkFeedSpot for PodcastersH3: CNBC’s Fast Money

Best for Daily Market News

Hosted by Melissa Lee, this fast-paced show delivers actionable stock market news and insights directly after market close—perfect for active or daily traders.DealroomFeedSpot for PodcastersWikipediaH3: The Journal (WSJ Podcast)

Top Choice for Business & Economy News

Produced by The Wall Street Journal and Spotify, this daily podcast blends business reporting with economic storytelling—and is praised for its depth and journalistic quality.Wikipedia

H3: Animal Spirits

For a Blend of Investing and Life

Broader than just the markets, hosts Michael Batnick and Ben Carlson weave market analysis with broader cultural and life topics—engaging for thoughtful investors.NYIF

H2: How to Choose the Right Podcast

- Start with your investing level—beginners might start with The Intrinsic Value Podcast, while seasoned investors may prefer Top Traders Unplugged.

- Choose your format—daily updates (e.g., Fast Money) vs. deep dives (e.g., We Study Billionaires).

- Mix learning and light content—balance educational shows with broader economic ones like The Journal.

- Check reputation—podcast coverage lists by Morningstar and DealRoom offer reliable sources.MorningstarDealroom

H2: Internal & External Resources

- Internal Links:

- Expand your market knowledge with [how to analyze market trends]

- Strengthen your portfolio with [how to manage a stock portfolio]

- Learn strategic hedging via [how to hedge investments]

- External Links:

- Discover investing podcasts recommended by MorningstarMorningstar

- Explore DealRoom’s curated list of financial podcastsDealroom

Conclusion

In 2025, there’s a wealth of stock market podcasts perfectly matched to every investor’s goals—be it strategic learning, daily news, or deep financial storytelling. Whether you’re just starting or honing your expertise, tuning into the right podcast can fuel your progress.

-

How to Trade Ethereum Safely in 2025: A Complete Guide

Filed under Blog, Crypto Currency & blockchainAug 17: Learn how to trade Ethereum safely in 2025 with practical tips on secure exchanges, wallets, risk management, and avoiding scams.Ethereum (ETH) is the second-largest cryptocurrency by market cap and the backbone of decentralized finance (DeFi) and NFTs. While ETH trading offers excellent profit opportunities, it also comes with risks such as volatility, scams, and exchange hacks.

If you’re wondering how to trade Ethereum safely, this guide will walk you through the best practices, tools, and strategies to protect your investment while making smart trading decisions.

Why Trade Ethereum?

Ethereum remains one of the most actively traded cryptocurrencies due to:

- 🌐 Strong ecosystem – Supports DeFi, NFTs, and smart contracts

- 📈 High liquidity – Easy to buy/sell ETH on global exchanges

- 🔮 Long-term potential – Transition to Ethereum 2.0 and staking rewards

- 💰 Profit opportunities – Day trading, swing trading, and HODLing

But with opportunity comes risk—making safe trading practices essential.

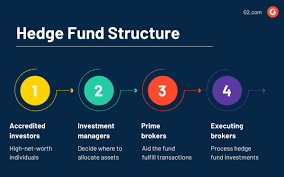

Step 1: Choose a Secure Crypto Exchange

The first step in safe Ethereum trading is selecting a reputable exchange. Look for:

- ✅ Licensing & Regulation – Exchanges regulated in the U.S., EU, or Asia

- 🔒 Security Features – 2FA, cold storage, insurance against hacks

- 💹 Liquidity – High ETH trading volume ensures smooth transactions

- 📊 User-Friendly Tools – Charts, indicators, and order types

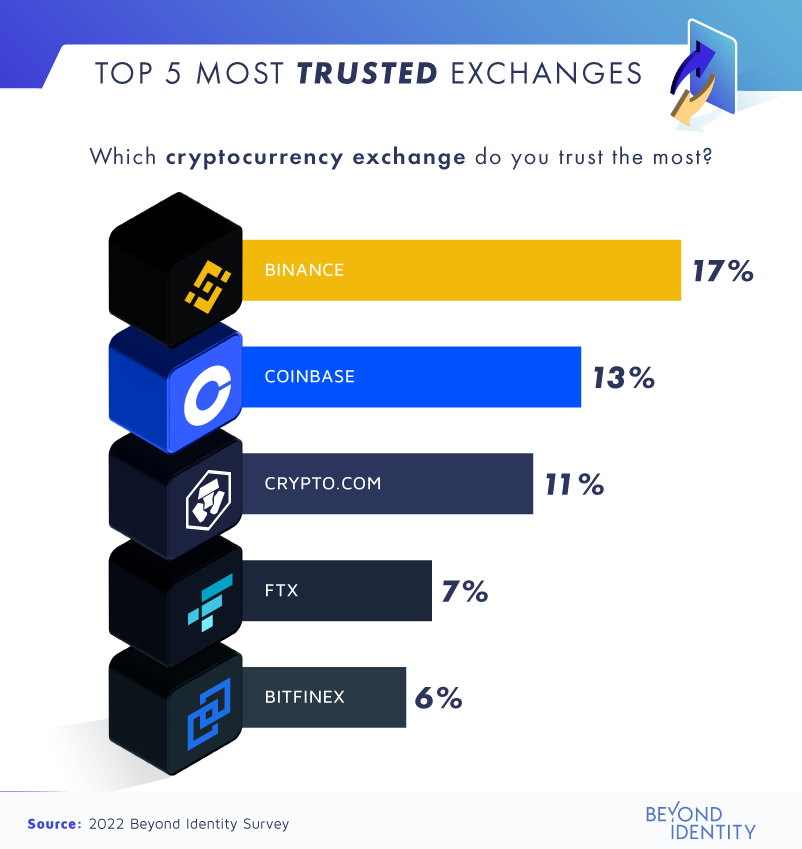

Recommended Exchanges:

- Binance – Best for advanced traders

- Coinbase – Beginner-friendly & regulated

- Kraken – Known for strong security

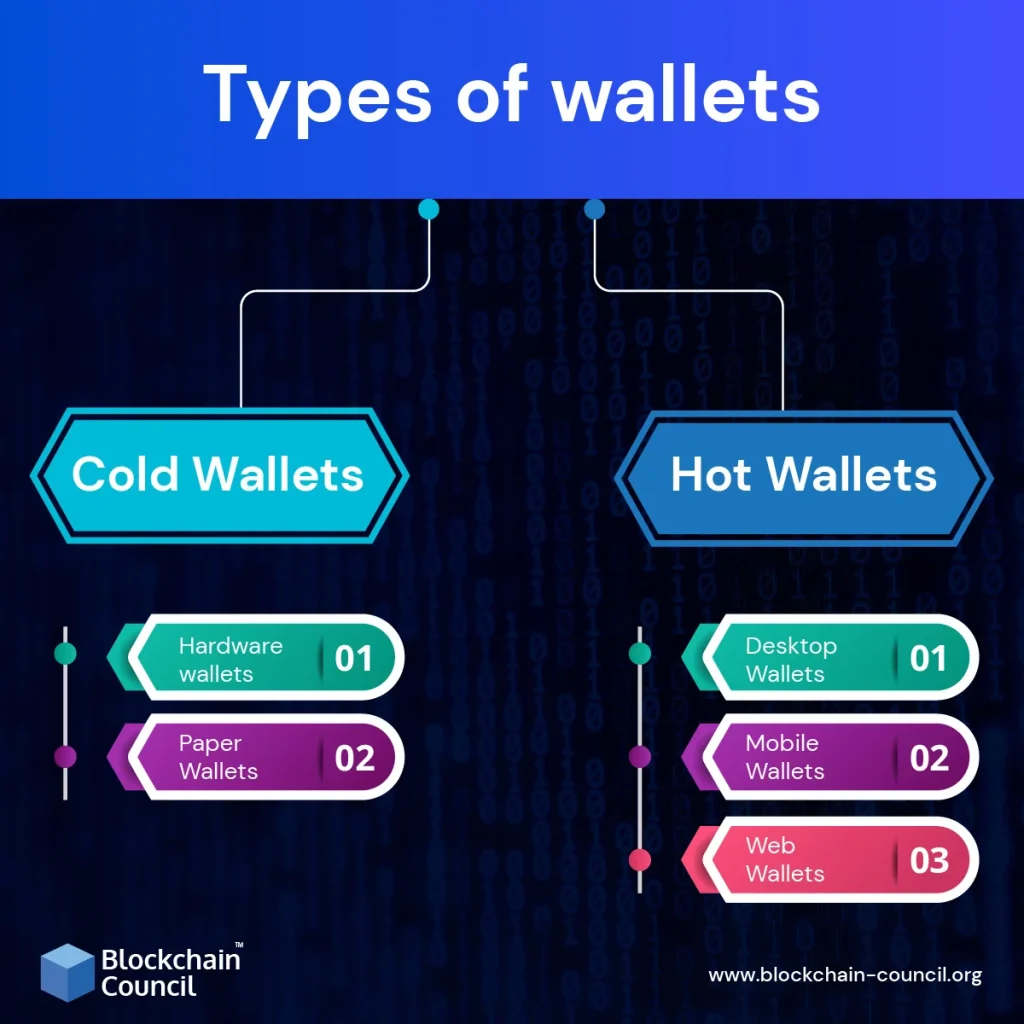

Step 2: Store Your Ethereum Safely

Never keep large amounts of ETH on exchanges. Use a crypto wallet instead:

Hot Wallets (Online)

- Examples: Trust Wallet, MetaMask

- Best for: Frequent traders

- Risk: More vulnerable to hacks

Cold Wallets (Offline/Hardware)

- Examples: Ledger Nano X, Trezor

- Best for: Long-term storage

- Benefit: Maximum security, offline protection

👉 Tip: Store trading funds in a hot wallet and long-term holdings in a cold wallet.

Step 3: Learn Different Ethereum Trading Strategies

1. Day Trading

- Buy/sell ETH within the same day

- Requires constant monitoring and technical analysis

2. Swing Trading

- Hold ETH for days or weeks

- Exploit medium-term market trends

3. Long-Term Holding (HODL)

- Buy and hold for years

- Ideal for believers in Ethereum’s future

4. Automated Trading (Bots)

- Use AI trading bots on exchanges

- Can manage trades 24/7 but requires caution

Step 4: Practice Risk Management

Ethereum is volatile, so risk management is crucial:

- 📉 Use Stop-Loss Orders – Automatically sell ETH if price drops

- 📊 Diversify Portfolio – Don’t put all money into Ethereum

- 💵 Invest Only What You Can Afford to Lose – Avoid over-leveraging

- ⏳ Start Small – Begin with small trades to minimize risk

Step 5: Avoid Ethereum Trading Scams

Scams are common in crypto. Stay safe by:

- 🚫 Avoiding “get rich quick” schemes promising high ETH returns

- ✅ Verifying all exchange apps on the official Google Play Store or App Store

- 🔒 Never sharing private keys or seed phrases

- 📩 Ignoring suspicious DMs, fake airdrops, and phishing links

Step 6: Stay Updated on Ethereum News

Ethereum’s price is influenced by:

- 📰 Regulatory updates

- 💻 Ethereum network upgrades (like ETH 2.0)

- 📊 Global crypto market trends

Follow reliable sources like:

Conclusion

Trading Ethereum can be both profitable and safe, provided you use secure exchanges, protect your assets with trusted wallets, and apply risk management strategies. Always stay informed, avoid scams, and trade responsibly.

👉 Final Tip: If you’re a beginner, start with regulated platforms like Coinbase or Kraken before moving to advanced exchanges like Binance.

-

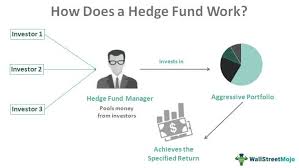

How to Hedge Investments: A Beginner’s Guide to Reducing Risk

Filed under Online Trading and Stock MarketAug 17Introduction

Every investor dreams of steady returns, but the reality is that markets are unpredictable. Inflation, geopolitical events, and economic downturns can all shake up your portfolio. That’s where hedging investments comes in. Much like insurance for your finances, hedging helps reduce potential losses without necessarily sacrificing long-term growth.

In this guide, you’ll learn what hedging is, why it matters, and practical strategies to hedge investments—even if you’re just starting out.

H2: What Does Hedging Mean in Investing?

Hedging is a risk management strategy that offsets potential losses in one investment by taking an opposite position in another. While it doesn’t guarantee profits, it helps smooth out volatility and gives investors peace of mind.

For example:

- If you own stocks, you might buy put options as insurance against price declines.

- If you invest internationally, you may hedge against currency fluctuations with futures contracts.

Think of hedging as a financial seatbelt—rarely exciting, but essential when conditions get rough.

H2: Why Hedging Investments Is Important

H3: Protection from Market Volatility

Markets are cyclical, and downturns are inevitable. A proper hedge cushions your portfolio against sudden drops.

H3: Preserving Long-Term Goals

For investors saving for retirement or education, hedging ensures that short-term risks don’t derail long-term plans.

H3: Confidence in Uncertain Times

By hedging, investors can stay invested without panic-selling when markets dip. This discipline is often the difference between mediocre and outstanding results.

H2: Popular Hedging Strategies

H3: 1. Diversification

The simplest form of hedging is spreading investments across different assets, sectors, and regions. If one asset class declines, others may rise or remain stable.

- Stocks and Bonds: Stocks may drop during recessions, while bonds often hold steady.

- Geographic Diversification: Exposure to global markets helps reduce risks tied to a single economy.

H3: 2. Options Contracts

Options are one of the most direct hedging tools.

- Put Options: Give you the right to sell at a set price, protecting against downside.

- Covered Calls: Generate income to offset potential losses.

H3: 3. Inverse and Leveraged ETFs

Exchange-traded funds (ETFs) designed to move opposite to market indexes can act as hedges. For instance, an inverse S&P 500 ETF rises when the index falls.

H3: 4. Commodities and Precious Metals

Assets like gold and silver often rise during times of economic uncertainty. They serve as natural hedges against inflation and currency risk.

H3: 5. Currency Hedging

International investors use futures or ETFs to protect against currency swings. For example, a U.S. investor in European stocks might hedge against the euro-dollar exchange rate.

H3: 6. Stop-Loss Orders

Though not a hedge in the traditional sense, setting stop-loss orders ensures you limit downside exposure on volatile stocks.

H2: Risks and Limitations of Hedging

- Costs: Options and futures contracts come with premiums and fees.

- Complexity: Some hedging instruments require advanced knowledge.

- Not Foolproof: Hedging reduces risk but can’t eliminate it entirely.

- Opportunity Cost: Hedging can sometimes limit potential profits.

H2: Practical Steps to Start Hedging Investments

- Assess Your Risk Tolerance – Understand how much volatility you’re comfortable with.

- Identify Major Risks – Inflation, market downturns, or currency fluctuations.

- Choose the Right Strategy – For beginners, diversification and ETFs are simplest.

- Start Small – Experiment with low-cost hedges like stop-loss orders or sector ETFs.

- Review Regularly – Markets change; update your hedging approach accordingly.

H2: Real-World Examples

- During 2020’s market crash, investors holding gold saw their portfolios fall less sharply than those holding only equities.

- Institutional investors often use derivatives to hedge billions in exposure, showing that even professionals rely on risk management.

H2: Recommended Tools and Resources

- Bloomberg – Global financial news and analysis (bloomberg.com).

- Investopedia’s Hedging Guide – Easy-to-understand breakdown of strategies (investopedia.com).

H2: Internal Learning Resources

- [How to Analyze Market Trends]

- [How to Manage a Stock Portfolio]

- [How to Invest in Index Funds]

Conclusion

Hedging investments isn’t about eliminating risk—it’s about managing it wisely. Whether you use diversification, options, or ETFs, the goal is the same: protecting your portfolio so you can stay the course.

By starting small and learning the basics, you’ll gain the confidence to face market turbulence with a steady hand.

Final Thought: Don’t wait for a downturn to think about hedging—prepare now, and future volatility will feel far less threatening.

-

top treadmills under 500

Filed under Blog, Fitness Equipment & SupplementAug 17Introduction

Thinking of adding cardio to your home gym without breaking the bank? Treadmills under $500 in 2025 offer a smart blend of functionality, compact design, and affordability. Whether you’re fitting workouts into busy mornings, maximizing limited space, or walking while working, this guide highlights the top models—each delivering real value without sacrificing key performance features.

Why Choose a Budget Treadmill in 2025

- Cost-Effective Access to Fitness: High-quality treadmills can exceed $2,000, but excellent under-$500 options now offer solid builds, multiple programs, and even incline features.BarBendCrazy Athlete

- Space-Saving Excellence: Many units fold flat or shrink to just a few inches high, ideal for apartments or multipurpose rooms.BarBendGarage Gym Reviews

- Feature-Rich Value: From manual incline levels to preset workout programs, these budget models pack useful functions without forcing a high price tag.BarBendCrazy Athlete

Top Picks: Best Treadmills Under $500 (2025)

Sunny Health & Fitness SF‑T4400 – Best Overall

- Why It Stands Out: Tops the list for its speed (up to 9 mph), three manual incline settings, nine workout programs, and space-saving foldability.BarBendProTechReview

- Pros:

- Manual incline adds training variety

- LCD console with workout tracking

- Hydraulic folding makes storage easy

- Cons:

- Incline must be set before workouts

- Running deck is relatively short

- Ideal For: Walkers and joggers seeking solid performance on a budget

Weslo Cadence G 5.9i – Best Value Overall

- What Makes It Great: Features up to 10 mph speed, a compact folding design, and a complimentary 30-day iFit trial.Crazy AthleteTreadmill Reviews

- Key Specs:

- 2.25 HP drive system

- Comfort cell cushioning for joint-friendly motion

- Best For: Beginners looking for basic coaching and treadmill simplicity on a minimal budget

XTERRA Fitness TR150 – Best for Small Spaces

- Standout Features: Foldable frame, 12 preset programs, and a cushioned deck make it ideal for limited spaces.Crazy AthleteGarage Gym Reviews

- Why Choose It:

- Large LCD for workout stats

- Lifetime warranty on the frame

- Great For: Walkers or light joggers with spatial constraints and limited budgets

UREVO 2‑in‑1 Under‑Desk Treadmill – Best Compact/Multifunction

- What Sets It Apart: Slick design folds flat under a bed or desk; can be used for walking or jogging when the handlebar is raised.BarBendGarage Gym Reviews

- Key Benefits:

- Max speed: 7.6 mph

- Shock-absorbing belt

- Perfect For: Multi-taskers or small home gyms seeking versatile, space-conscious solutions

Egofit Walker Pro – Best Under‑Desk Incline Walker

- Why It Matters: Rare under‑$500 option with fixed incline (~5%), easy setup, and a lightweight design.BarBendPeople.com

- Ideal Use Cases:

- Walking during work or TV time

- Convenient for sustained daily use without a big footprint

Goplus 2‑in‑1 Folding Treadmill – Best Folding Design

- Highlight Reel: Folds into a 5-inch profile; can be used as under-desk or full treadmill with a max speed around 7.5 mph.BarBendthewildtrend.com

- Why It’s Worth It:

- Great storage flexibility

- Suitable for light jogging and walking workflows

- Ideal For: Consumers needing portability and compact performance on a budget

Quick Comparison Table

Goal / Need Recommended Model Best comprehensive value Sunny Health & Fitness SF-T4400 Best overall bargain Weslo Cadence G 5.9i Space-conscious choice XTERRA TR150 Multi-task/under-desk use UREVO 2‑in‑1 Incline walking priority Egofit Walker Pro Folding, storage ease Goplus 2‑in‑1 Folding

How to Choose the Right One for You

Match Model to Your Space Constraints

- Tight and multipurpose spaces: compact runners like UREVO or Goplus offer fold-away designs.

- Dedicated workout area: SF‑T4400 or Weslo provide more surface and training variety.

Set Workout Goals

- Walkers or desk users: Egofit Walker Pro or under‑desk options maximize movement without interruption.

- Improved cardio/higher intensity: SF‑T4400 and Weslo Cadence deliver better speed and incline capacity.

Prioritize Features That Matter

- Incline capability: Not common under $500, but notable in SF‑T4400 and Egofit.

- Programs and entertainment: Weslo offers iFit; SF‑T4400 includes built-in training modes.

- Cushioning and joint care: Weslo’s Comfort Cell; XTERRA’s XTRA Soft; UREVO’s shock absorption systems help reduce impact.

SEO & Accessibility Highlights

- Mobile-friendly: Short paragraphs, descriptive headers, and bullet lists ensure easy reading on small screens.

- Alt Text Examples for Images:

- “Sunny Health & Fitness SF‑T4400 compact treadmill folded for storage”

- “Under‑desk UREVO treadmill used in a home office setup”

- “Egofit Walker Pro walking pad with built-in incline”

Conclusion

Budget treadmills under $500 in 2025 no longer mean stripped-down basics—they deliver practical, versatile, and compact fitness solutions. Whether you’re juggling work while walking with Egofit, tucking away the UREVO under your sofa, or getting a full jog in with the SF‑T4400, there’s a smart, space-sensitive, and wallet-conscious option waiting for you.

Ready to step into home fitness? Choose your ideal treadmill, set up a cozy workout corner, and let your indoor strides take you closer to your health goals—without stretching your budget.

-

Aug 17

Introduction

In 2025, as markets evolve with emerging technologies, global shifts, and new financial philosophies, investors benefit more than ever from learning through books. Whether you’re new to the markets or deepening your existing knowledge, choosing the right investment books can sharpen your strategy and broaden your perspective.

From enduring classics like The Intelligent Investor to modern works redefining wealth, here are the best investment books of 2025—carefully selected to guide, inspire, and empower your financial journey.

H2: Timeless Classics That Still Resonate

H3: The Intelligent Investor – Benjamin Graham

Frequently cited as the ultimate value investing guide, The Intelligent Investor emphasizes a disciplined, emotionally rational approach. Warren Buffett praises it as “by far the best book on investing ever written.” A 2024 edition adds commentary by Jason Zweig, bringing Graham’s principles into the modern era.The AustralianWikipedia

H3: The Little Book of Common Sense Investing – John C. Bogle

Vanguard founder John Bogle presents a compelling case for simple, low-cost index fund investing. His core message: minimizing costs is just as important as choosing the right asset.Wikipedia

H3: Security Analysis – Benjamin Graham & David L. Dodd

This heavy-hitting classic laid the foundation of value investing. Highly recommended by Warren Buffett and highly technical, it’s essential for serious students of equity valuation.Inc.comBusiness Insider

H2: Modern Investment Must-Reads in 2025

H3: The 5 Types of Wealth – Sahil Bloom

A fresh and timely release in 2025, this book expands wealth beyond money to include physical, mental, time, and social wealth. Its holistic view reflects modern investing needs.Wikipedia

H3: The Millionaire Next Door & Rich Dad Poor Dad – Behavioral Classics

These two books emphasize wealth-building through disciplined saving, frugality, and financial education. They’ve inspired real-life investors toward financial independence.Business Insider

H3: The Psychology of Money – Morgan Housel

A modern classic that emphasizes behavior over technical strategy—teaching that financial success hinges on psychology, not formulas. Featured in personal finance discussions throughout 2025.Barron’s

H2: Alternative Economic and Behavioral Perspectives

H3: Frontier: An Emerging Markets Story

This thoughtful narrative examines Western investment in emerging economies, offering lessons on global markets, culture, and historical mistakes.Financial Times

H3: Human Capital for Humans

Grounded in Nobel Prize-winning theory, this book explores how human skills—beyond credentials—are the most enduring investments in the age of AI.Financial Times

H2: Quick Reference Table of Top Picks

Category Title & Author Value Investing Classics The Intelligent Investor – Benjamin Graham Index Investing Essentials The Little Book of Common Sense Investing – John Bogle Deep Value Foundation Security Analysis – Graham & Dodd Modern Wealth Framework The 5 Types of Wealth – Sahil Bloom Behavioral Wealth Insights The Psychology of Money – Morgan Housel Practical Wealth Mindset The Millionaire Next Door / Rich Dad Poor Dad Global Perspective Frontier: An Emerging Markets Story Human Capital Understanding Human Capital for Humans

H2: Why These Books Matter in 2025

- Blend of timeless wisdom and modern context – foundational principles meet contemporary relevance.

- Cover behavioral, structural, and global insights – equipping you with a well-rounded investing mindset.

- Backed by authority – praised by legends like Buffett and shaping modern thought leaders.

Internal & External Resources

Internal Links:

- Explore [how to invest in index funds]

- Discover [how to analyze market trends]

- Learn [how to manage a stock portfolio]

External Links:

- GOBankingRates recommending the updated edition of The Intelligent InvestorNasdaq

- FT’s review of new economic titles including Frontier and Human Capital for HumansFinancial Times

Conclusion

Whether you’re deepening your investing knowledge or redefining wealth altogether, the top investment books of 2025 provide a powerful mix: classic rigor, behavioral mastery, and modern relevance. Read these, reflect, and let their lessons elevate your investing confidence.

-

How to Analyze Market Trends: A Complete Guide for Investors

Filed under Online Trading and Stock MarketAug 17Introduction

Financial markets move in cycles—rising, falling, and consolidating in patterns that reveal opportunities for investors and traders. Understanding how to analyze market trends is one of the most valuable skills in finance. Whether you’re a beginner investor or a seasoned professional, market trend analysis helps you make informed decisions, reduce risk, and identify profitable entry and exit points.

In this guide, we’ll break down the key methods of market analysis, explore tools used by professionals, and provide actionable steps so you can start analyzing trends like an expert.

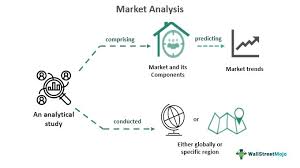

H2: What Are Market Trends?

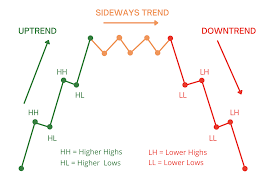

Market trends represent the general direction in which an asset, sector, or the overall market is moving. They can be:

- Uptrends: Prices consistently make higher highs and higher lows.

- Downtrends: Prices make lower highs and lower lows.

- Sideways trends (consolidation): Prices move within a defined range, showing indecision.

Recognizing these patterns is the foundation of effective investing and trading.

H2: Methods of Analyzing Market Trends

H3: 1. Technical Analysis

Technical analysis involves studying price charts, volume, and indicators to predict future movements. Common tools include:

- Moving Averages: Identify long-term direction by smoothing price data.

- Relative Strength Index (RSI): Measures momentum and overbought/oversold conditions.

- Support & Resistance Levels: Help spot breakout or reversal points.

- Chart Patterns: Such as head-and-shoulders, triangles, and double bottoms.

Example: If the S&P 500 index consistently stays above its 200-day moving average, analysts often consider it to be in a long-term uptrend (Investopedia).

H3: 2. Fundamental Analysis

Fundamental analysis looks at economic, financial, and company-specific data. Key areas include:

- Earnings Reports: Revenue growth and profit margins drive long-term stock trends.

- Macroeconomic Indicators: GDP growth, unemployment rates, and inflation data affect overall market direction.

- Industry Trends: Sectors like AI, renewable energy, or biotech may outperform during specific cycles.

For instance, during high inflation periods, investors often shift toward defensive sectors like healthcare and consumer staples.

H3: 3. Sentiment Analysis

Market psychology plays a massive role in trend formation. Sentiment indicators include:

- Fear & Greed Index: Measures investor emotions influencing price moves.

- Put/Call Ratio: High values may indicate bearish sentiment.

- Social Media Trends: Platforms like Twitter and Reddit can spark short-term volatility in meme stocks.

A good investor combines sentiment with technical and fundamental analysis for a more complete outlook.

H2: Tools to Analyze Market Trends

- Charting Platforms: TradingView, Thinkorswim, or MetaTrader.

- News & Data Feeds: Bloomberg, Reuters, Yahoo Finance.

- Economic Calendars: Track events like Fed announcements, CPI reports, and earnings releases.

- Screening Tools: Finviz or MarketWatch for filtering stocks based on trend criteria.

(Alt text suggestion for images: “technical chart showing moving averages for analyzing market trends”)

H2: Step-by-Step Process to Analyze Market Trends

- Identify the timeframe: Long-term investors may focus on weekly or monthly charts, while day traders prefer 5-minute or hourly charts.

- Check broader market indices: Start with benchmarks like the S&P 500 or Nasdaq to gauge overall direction.

- Apply technical indicators: Use moving averages or trendlines to confirm momentum.

- Evaluate fundamentals: Look at earnings, sector performance, and macroeconomic conditions.

- Incorporate sentiment: Analyze investor behavior through market news, options data, and sentiment indices.

- Set entry and exit points: Define stop-loss and profit targets to manage risk.

H2: Common Mistakes to Avoid

- Relying on one method: Using only technical or only fundamental analysis can lead to blind spots.

- Ignoring macroeconomic news: Events like interest rate changes can shift trends instantly.

- Chasing hype: Following social media-driven surges without research often results in losses.

- Overcomplicating analysis: Too many indicators may confuse instead of clarify.

H2: Why Market Trend Analysis Matters

- Helps minimize risk by avoiding trades against the dominant trend.

- Provides timely entry and exit points for maximum profitability.

- Encourages discipline by following structured strategies instead of emotions.

- Enhances portfolio management, helping you rebalance according to changing conditions.

For example, in 2023–2024, investors who spotted the AI trend early significantly outperformed the broader market.

Internal & External Resources

- Internal links:

- Learn [how to manage a stock portfolio]

- Explore [how to invest in index funds]

- Discover [best trading apps for beginners]

- External links:

Conclusion

Market trends are the heartbeat of investing. By combining technical, fundamental, and sentiment analysis, investors gain a clearer view of where opportunities lie and where risks might emerge. The key is balance: don’t over-rely on one method, but instead use a mix of tools to develop a complete picture.

-

How to Choose Travel Insurance Policy: A Complete Guide for 2025

Filed under Travel Insurance & Adventure TravelAug 17Introduction

Traveling is exciting, but it also comes with uncertainties—delayed flights, lost luggage, sudden illnesses, or unexpected cancellations. That’s why having the right travel insurance policy is essential. Yet, with dozens of providers and endless fine print, figuring out how to choose the right policy can feel overwhelming.

This guide will walk you through the key factors to consider when selecting travel insurance, helping you make a smart choice that balances coverage, cost, and peace of mind. Whether you’re planning a short weekend getaway or a long international trip, understanding your options ensures you’re fully protected.

Why Travel Insurance Matters

According to the U.S. Travel Insurance Association (UStiA), nearly one in six travelers experiences unexpected disruptions during their trip. Without insurance, these surprises can lead to significant financial loss.

Travel insurance provides coverage for:

- Trip cancellations or delays

- Medical emergencies abroad

- Lost or stolen baggage

- Adventure or sports-related accidents (depending on policy)

👉 If you’re planning an adventurous trip, you may also like our guide on top adventure resorts 2025.

Key Factors to Consider When Choosing a Travel Insurance Policy

1. Assess Your Travel Needs

Every trip is different. Consider:

- Destination: Medical care costs vary worldwide. For example, treatment in the U.S. can be much more expensive than in Europe or Asia.

- Trip Duration: Longer trips require extended coverage.

- Activities Planned: Extreme sports like skiing or scuba diving may need special add-ons.

2. Understand Types of Travel Insurance Coverage

Travel insurance isn’t one-size-fits-all. Here are the most common types:

- Trip Cancellation Insurance – Reimburses prepaid expenses if you need to cancel due to illness, injury, or unforeseen circumstances.

- Medical Coverage – Covers emergency medical expenses and sometimes evacuation.

- Baggage & Personal Belongings – Protects against theft, loss, or delay of luggage.

- Comprehensive Insurance – A bundle that usually includes trip, medical, and baggage coverage.

👉 For travelers planning multiple vacations, read our guide on how to find travel companions to share costs and experiences.

3. Compare Coverage Limits and Exclusions

Before purchasing, carefully read the coverage limits and exclusions:

- Does the policy cover pre-existing medical conditions?

- What’s the maximum payout for medical emergencies?

- Is adventure sports coverage included or excluded?

- Are pandemics or epidemics covered (many providers updated this post-2020)?

📌 Tip: Always review the “fine print” to avoid unpleasant surprises.

4. Check Provider Reputation and Customer Support

Not all insurance companies are equal. Look for:

- Strong financial stability ratings (A.M. Best or Standard & Poor’s)

- Positive customer reviews and claim settlement ratios

- 24/7 customer support availability while abroad

5. Balance Cost vs. Value

The cheapest policy isn’t always the best. Instead of focusing solely on price, evaluate:

- Coverage inclusions vs. exclusions

- Deductibles (what you pay before insurance kicks in)

- Optional add-ons that may be worth it (adventure sports, rental car protection, etc.)

Additional Tips for Buying Travel Insurance

- Buy Early: Purchase coverage as soon as you book your trip to maximize benefits.

- Bundle with Credit Card Perks: Some credit cards offer basic travel protection—compare it with standalone policies.

- Consider Annual Plans: If you travel frequently, annual coverage may be more cost-effective than per-trip insurance.

Alt text for image: “Traveler reviewing travel insurance policy documents before trip.”

Common Mistakes to Avoid

- Assuming your health insurance covers international travel (often it doesn’t).

- Overlooking exclusions like high-risk sports or pre-existing conditions.

- Waiting until the last minute to purchase coverage.

- Choosing based solely on price instead of value.

External Resources for Travel Insurance Research

-

Top Adventure Resorts 2025: Where Thrill Meets Luxury

Filed under Travel Insurance & Adventure TravelAug 17Introduction

Adventure travel continues to soar in popularity as more travelers seek experiences that combine adrenaline, luxury, and cultural immersion. Instead of a typical beach vacation, today’s explorers crave thrilling activities like zip-lining, mountain biking, scuba diving, and hiking—all while staying in world-class resorts that cater to comfort and style.

In 2025, the top adventure resorts are setting new standards, offering everything from eco-lodges in the jungle to ski-in chalets in the Alps. Whether you’re an adrenaline junkie, a nature enthusiast, or simply someone looking to break free from routine, these resorts promise the best of both worlds: heart-racing adventure with five-star relaxation.

Why Adventure Resorts Are Trending in 2025

The global adventure tourism market is projected to reach $1.3 trillion by 2030 (Allied Market Research), and resorts are adapting quickly. In 2025, travelers aren’t just booking stays—they’re booking experiences. Resorts now combine sustainable travel, curated excursions, and wellness retreats to meet growing demand.

👉 For solo adventurers, check out our guide on how to find travel companions.

Top Adventure Resorts 2025

Below are some of the most exciting resorts around the world offering thrilling activities, unique landscapes, and top-tier hospitality.

1. Explora Patagonia Lodge – Torres del Paine, Chile

Located in the heart of Patagonia’s wilderness, this lodge is a dream for hikers and explorers.

- Guided treks to the iconic Torres del Paine peaks

- Horseback riding with local gauchos

- Stargazing experiences in one of the clearest skies in the world

Alt text for image: “Explora Patagonia Lodge adventure resort in Chile with mountains and lakes.”

👉 Related read: best luggage for adventure travel

2. Amangiri Resort – Utah, USA

Nestled in the dramatic landscapes of the American Southwest, Amangiri blends luxury with rugged adventure.

- Hot air balloon rides over desert canyons

- Rock climbing and canyoneering in slot canyons

- Access to Navajo cultural experiences

The resort’s architecture merges seamlessly with the desert, offering a serene escape after action-packed days.

3. Six Senses Zighy Bay – Oman

Set between the Hajar Mountains and the Gulf of Oman, this resort is famous for its thrilling arrival option: paragliding into the property.

- Paragliding, mountain biking, and diving

- Sunset dhow cruises for relaxation

- Eco-conscious luxury with sustainable design

4. Whitepod Eco-Luxury Hotel – Valais, Switzerland

For eco-minded adventurers, Whitepod offers a glamping experience with pod-shaped lodges overlooking the Swiss Alps.

- Skiing and snowboarding in winter

- Hiking and mountain biking in summer

- Eco-tourism focus with minimal environmental impact

5. Chaa Creek Lodge – Belize

A pioneer in eco-adventure resorts, Chaa Creek blends lush rainforests with cultural immersion.

- Jungle trekking and river canoeing

- Visits to ancient Mayan ruins

- On-site butterfly farm and natural history museum

Alt text for image: “Chaa Creek Lodge adventure resort in Belize surrounded by rainforest.”

6. Soneva Fushi – Maldives

Known for barefoot luxury, Soneva Fushi adds an adventurous twist to the classic Maldives escape.

- Snorkeling and diving with manta rays

- Robinson Crusoe-style private island dining

- Outdoor cinema under the stars

7. Niseko Village – Hokkaido, Japan

For snow lovers, Niseko Village is among the top ski adventure resorts in 2025.

- Powder skiing and snowboarding on world-class slopes

- Snowshoe tours and hot spring experiences

- Summer mountain biking and zip-lining

👉 Planning a trip? Learn more in our guide on how to plan solo adventure trips.

Key Features of Adventure Resorts

When choosing an adventure resort in 2025, here are features to look out for:

- Range of Activities: Resorts should offer diverse options for all skill levels.

- Sustainability: Eco-conscious resorts are increasingly popular among travelers.

- Wellness Integration: Adventure balanced with yoga, spa, or meditation.

- Cultural Experiences: Opportunities to connect with local traditions.

Safety and Preparation Tips

Adventure travel comes with risks, but preparation ensures safety:

- Research the resort’s safety certifications.

- Invest in proper gear—see our guide on how to pack light for adventure trips.

- Check activity difficulty levels before booking.

- Ensure you have proper travel insurance for adventure sports.

External Resources for Adventure Travelers

Categories

- Academic Programs (9)

- Accident Insurance (5)

- Artificial Intelligence & Machine Learning (24)

- Blog (113)

- Car Insurance (4)

- CBD Products (1)

- Cloud Computing &SaaS (24)

- Crypto Currency & blockchain (24)

- Fitness Equipment & Supplement (15)

- Home Security & Smart Home Tech (9)

- Legal News and Trends (7)

- Life Insurance (4)

- Luxury Cars & Auto Reviews (24)

- Luxury Real Estate (24)

- Market Analysis and Insights (6)

- Online Trading and Stock Market (18)

- Travel Insurance & Adventure Travel (24)

- Travel Tips (8)

- Uncategorized (3)

Recent Articles

- Bodoland Lottery Today Result 3PM 18.9.2025 Assam State Lotteries

- Bhutan State Lottery Result for 18.09.2025 – 12 PM, 6 PM, and 8 PM Draws

- Sikkim State Lottery Result for 18.09.2025 – 1 PM Morning Draw

- Best Smart Lighting Systems in 2025

- Home Security Tips for Families

- Top Smart Thermostats for Home in 2025

- Best CBD Oils for Anxiety: Top Picks, Benefits, and How to Choose

- Top Top-Rated Sports Cars

- How to Upgrade Car Interiors: A Complete Guide to Luxury and Comfort

- Best Luxury Cars for Long Trips